RS Aggarwal Class 8 Solutions Chapter 10

RS Aggarwal Solutions for Class 8 Chapter 10 – Profit and Loss PDF

RS Aggarwal Class 8 Maths Solutions Chapter-wise – Free PDF Download

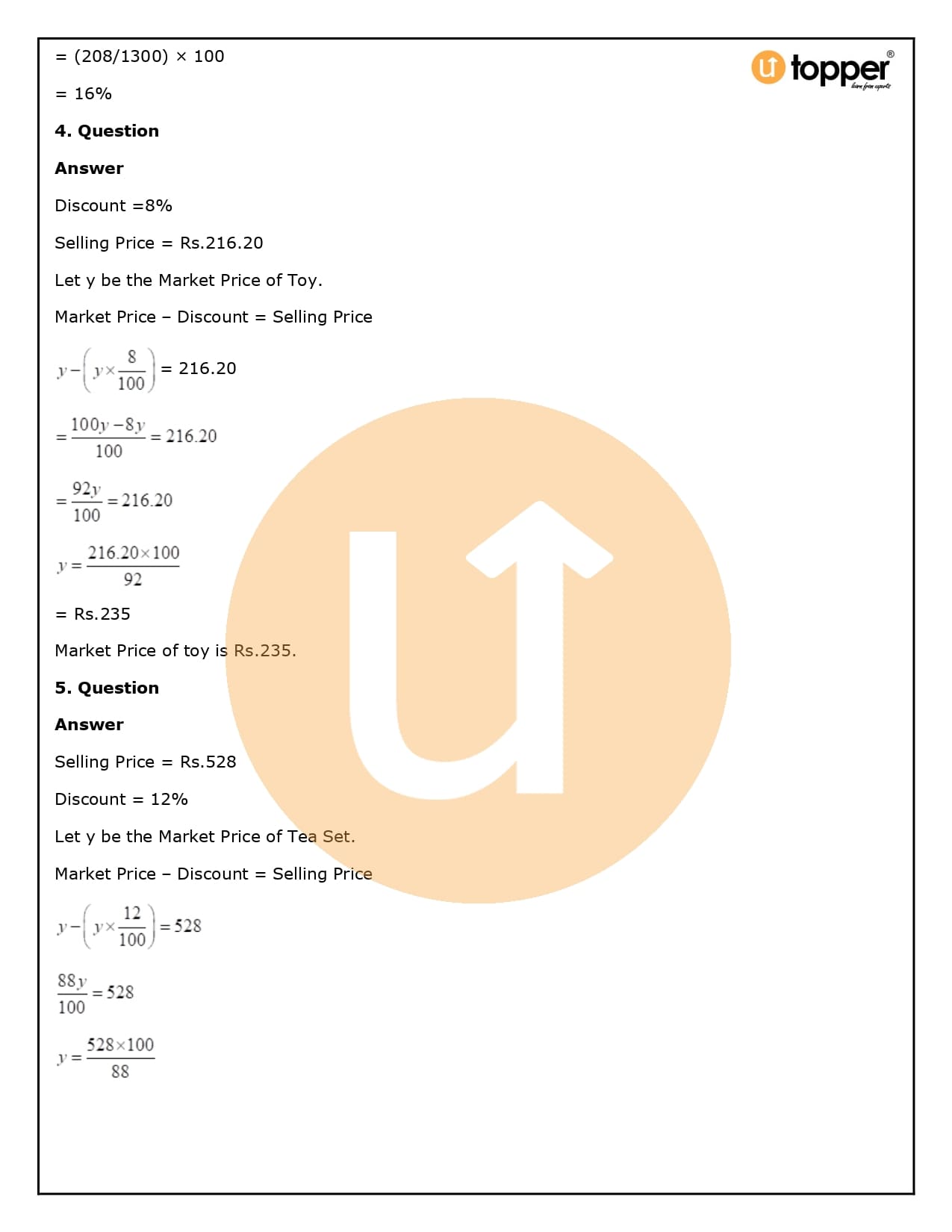

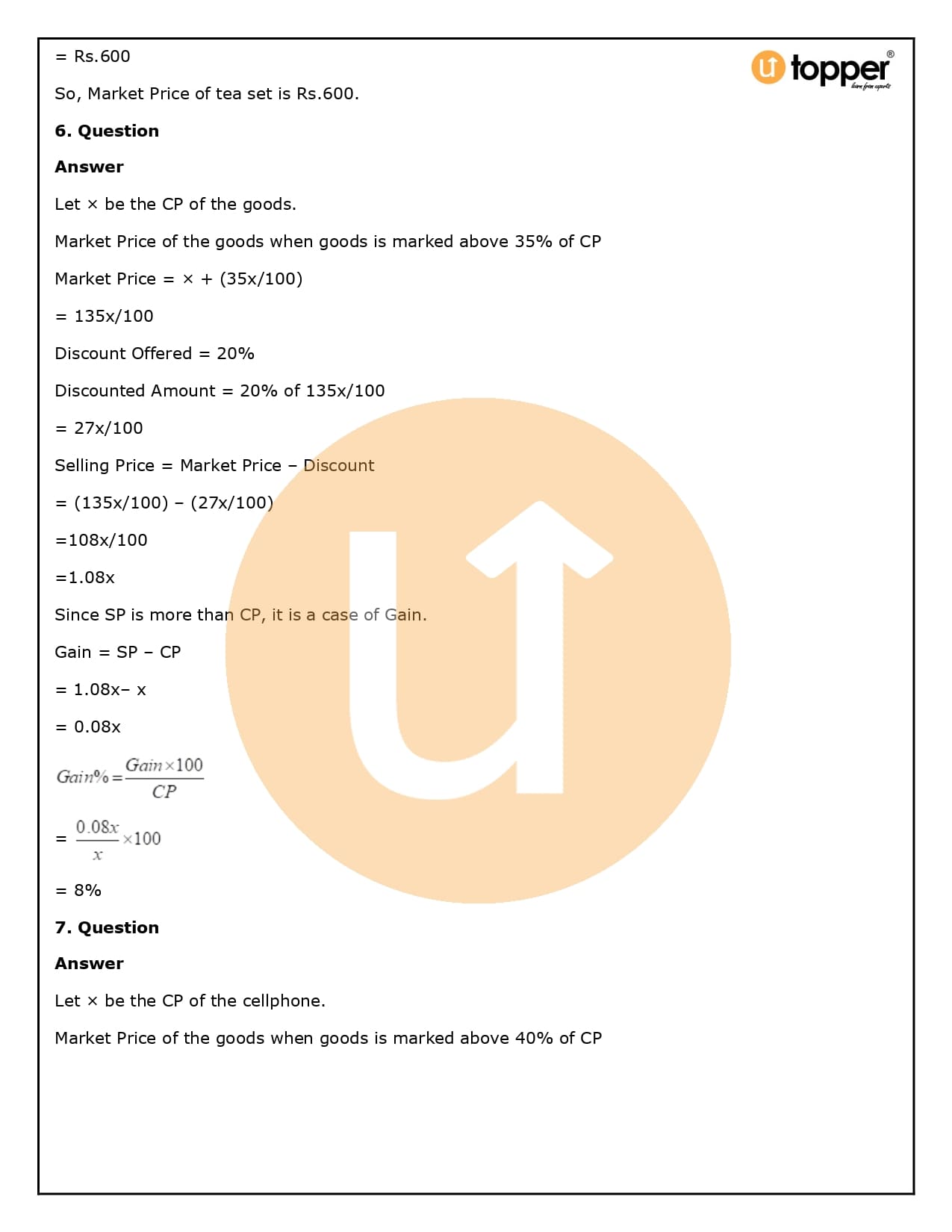

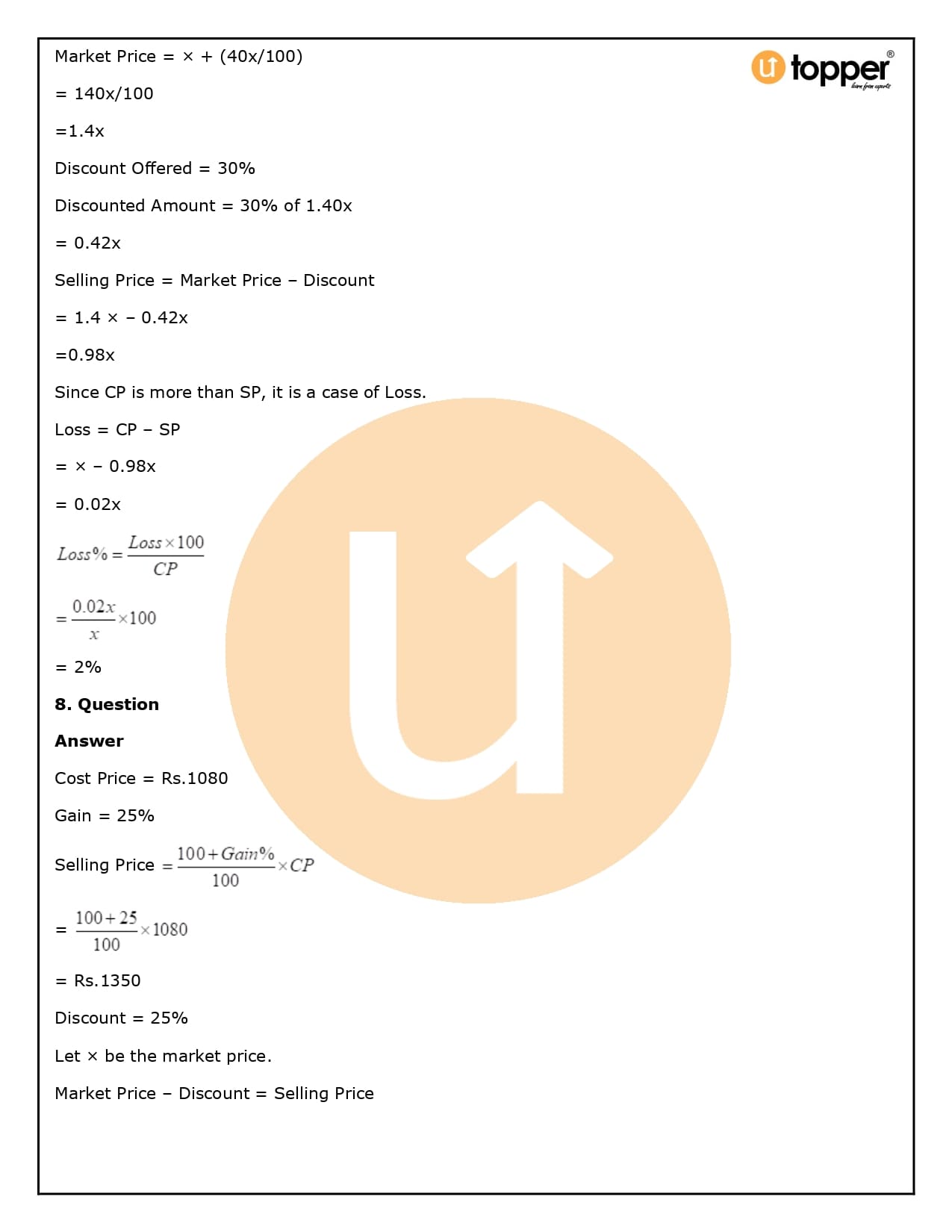

The “Profit and Loss” for RS Aggarwal Class 8 Solutions Chapter 10 will help you do the chapter’s exercises without getting confused. In this chapter of RS Aggarwal Class 8 Solutions, you need to use your knowledge of percentages and ratios to find the gain percentage, the loss percentage, the cost price, the selling price, discounts, discount percentages, and the marked price. This chapter has 4 exercises with about 80 practice questions each.

Utopper has the answers to RS Aggarwal Solutions for Class 8 Chapter 10 on its website. Profit and Loss is the subject of Chapter 10 of Math. In class 8, RS Aggarwal’s Profit and Loss chapter is primarily about learning the basics of profit and loss and how to figure them out using different formulas.

The solutions that Utopper gives are elementary to believe. The step-by-step solutions to each chapter’s sums help the student understand the whole chapter better. Chapter 10’s solutions are in a pdf file that you can get free from Utopper. Utopper is a website where students can get free NCERT Solutions and other study materials. If you have access to RS Aggarwal Class 8 Solutions, Science, Maths solutions, and solutions for other subjects, it will be easier to study subjects like Science, Maths, and English. You can also access Class 8 Maths RD Sharma Solutions to help you review the whole curriculum and get better test grades.

Utopper is a website where students can get free Reference Book Solutions and other study materials like Revision notes, Sample papers, and Important Question class 8. Science and Maths will be easier to learn if you have access to RS Aggarwal Solutions for Class 8 and solutions for other courses.

Click Here – To Buy/Purchase RS Aggarwal Class 8 Solutions Online

RS Aggarwal Class 8 Solutions Chapter 10 – Profit and Loss

RS Aggarwal Class 8 Solutions

Chapter-1 Rational Numbers

Chapter-2 Exponents

Chapter-3 Squares and Square Roots

Chapter-4 Cubes and Cube Roots

Chapter-5 Playing with Numbers

Chapter-6 Operations on Algebraic Expressions

Chapter-7 Factorisation

Chapter-8 Linear Equations

Chapter-9 Percentage

Chapter-10 Profit and Loss

Chapter-11 Compound Interest

Chapter-12 Direct and Inverse Proportions

Chapter-13 Time and Work

Chapter-14 Polygons

Chapter-15 Quadrilaterals

Chapter-16 Parallelograms

Chapter-17 Construction of Quadrilaterals

Chapter-18 Area of a Trapezium and a Polygon

Chapter-19 Three-Dimensional Figures

Chapter-20 Volume and Surface Area of Solids

Chapter-21 Data Handling

Chapter-22 Constructing and Interpreting Bar Graphs

Chapter-23 Pie Charts

Chapter-24 Probability

Chapter-25 Graphs

Important Topics for RS Aggarwal Class 8 Solutions Chapter 10: Profits and Loss

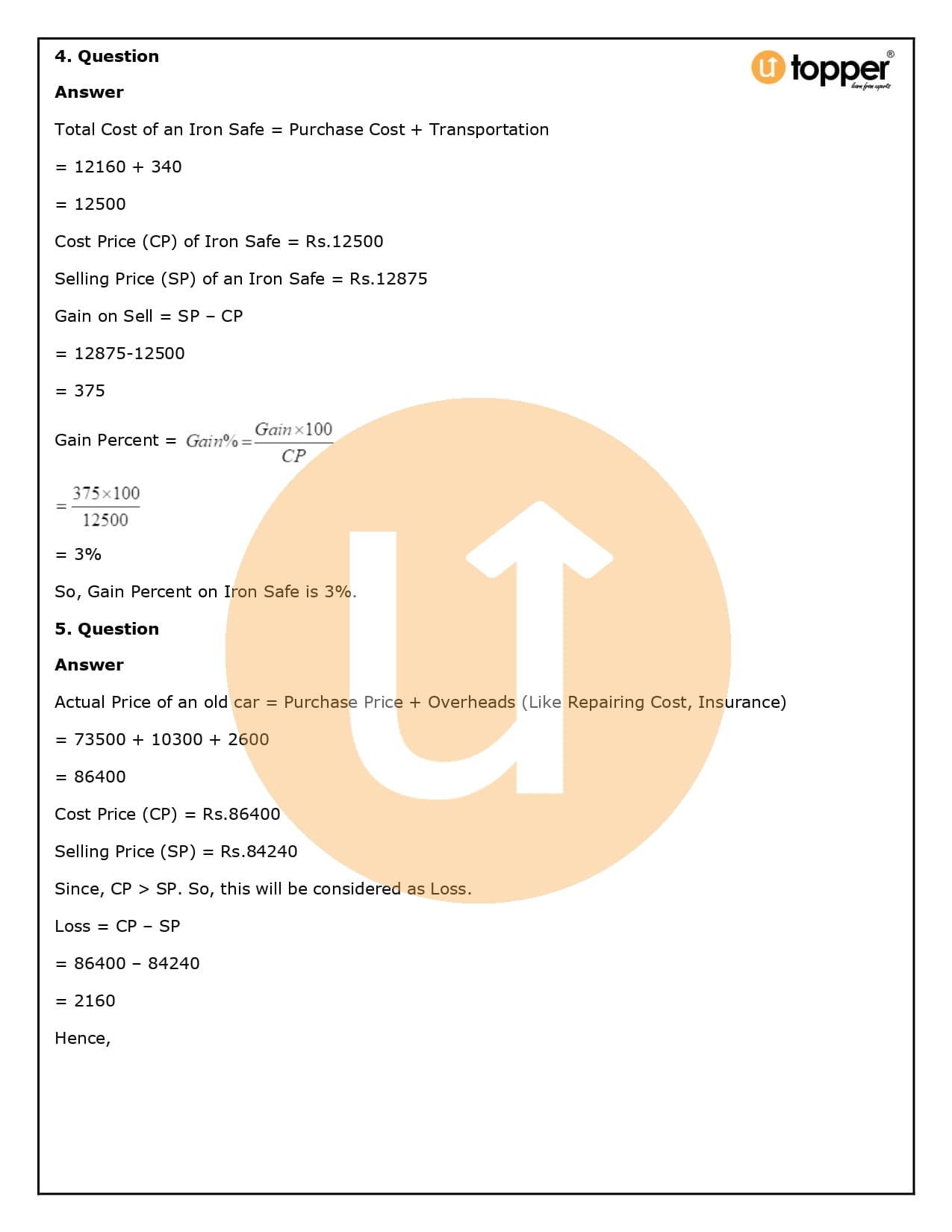

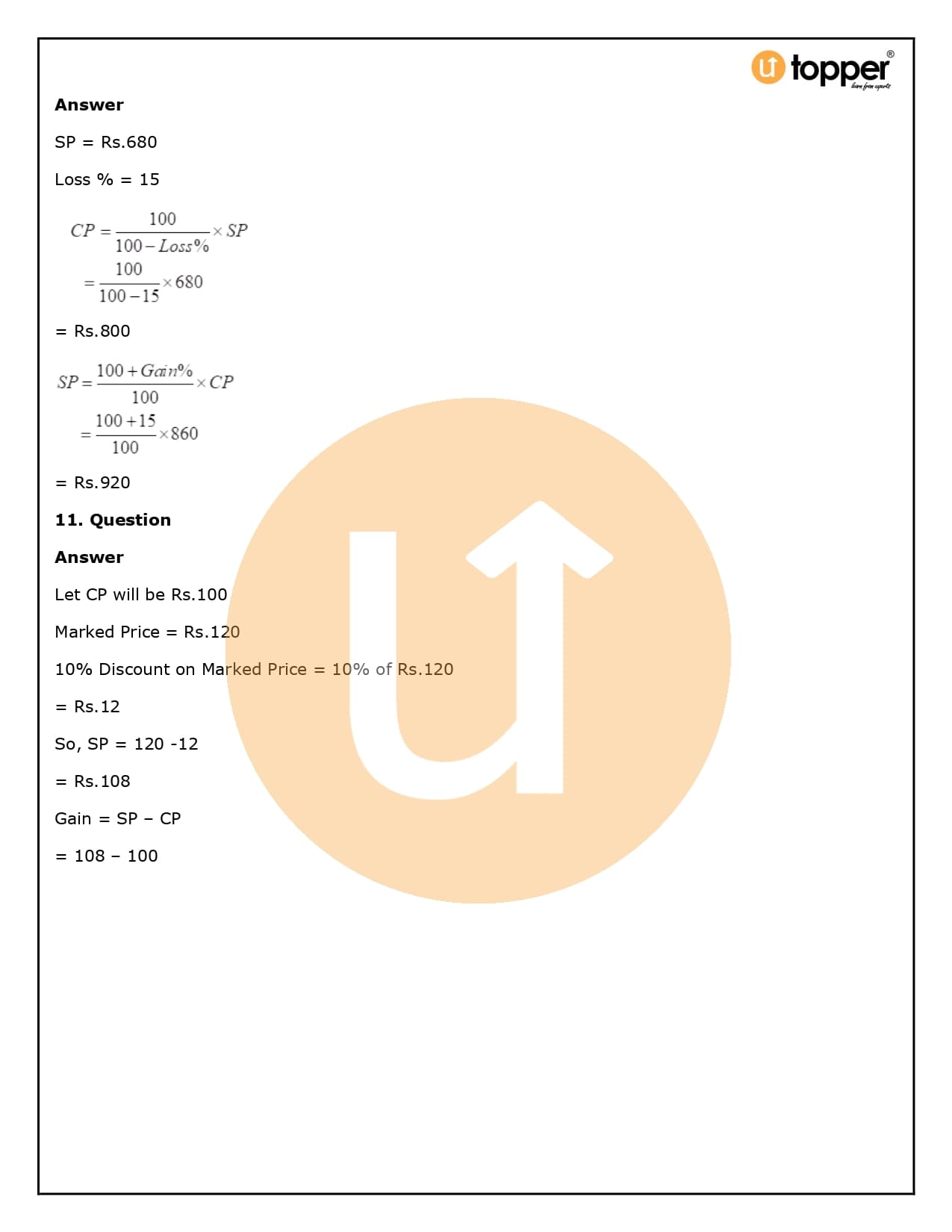

Cost Price, Selling Price, and Marked Price

Cost The price of an item is how much it really costs to make or buy that item. For example, it costs Rs.100 to make a chair. It means that the shop owner who is selling that chair bought it for Rs.100 from the maker or made it himself. This includes taxes, fees for labor, and transportation costs.

The price at which an item is sold to a customer is called its selling price. For example, if a shopkeeper sells a chair to a customer for Rs.200, the chair’s selling price for that customer is Rs.200. The shopkeeper could sell the same chair to another customer for, say, Rs. 150 less. The chair would cost Rs. 150 to sell at that point. How much a shopkeeper or seller makes or loses depends on how much they charge for their goods.

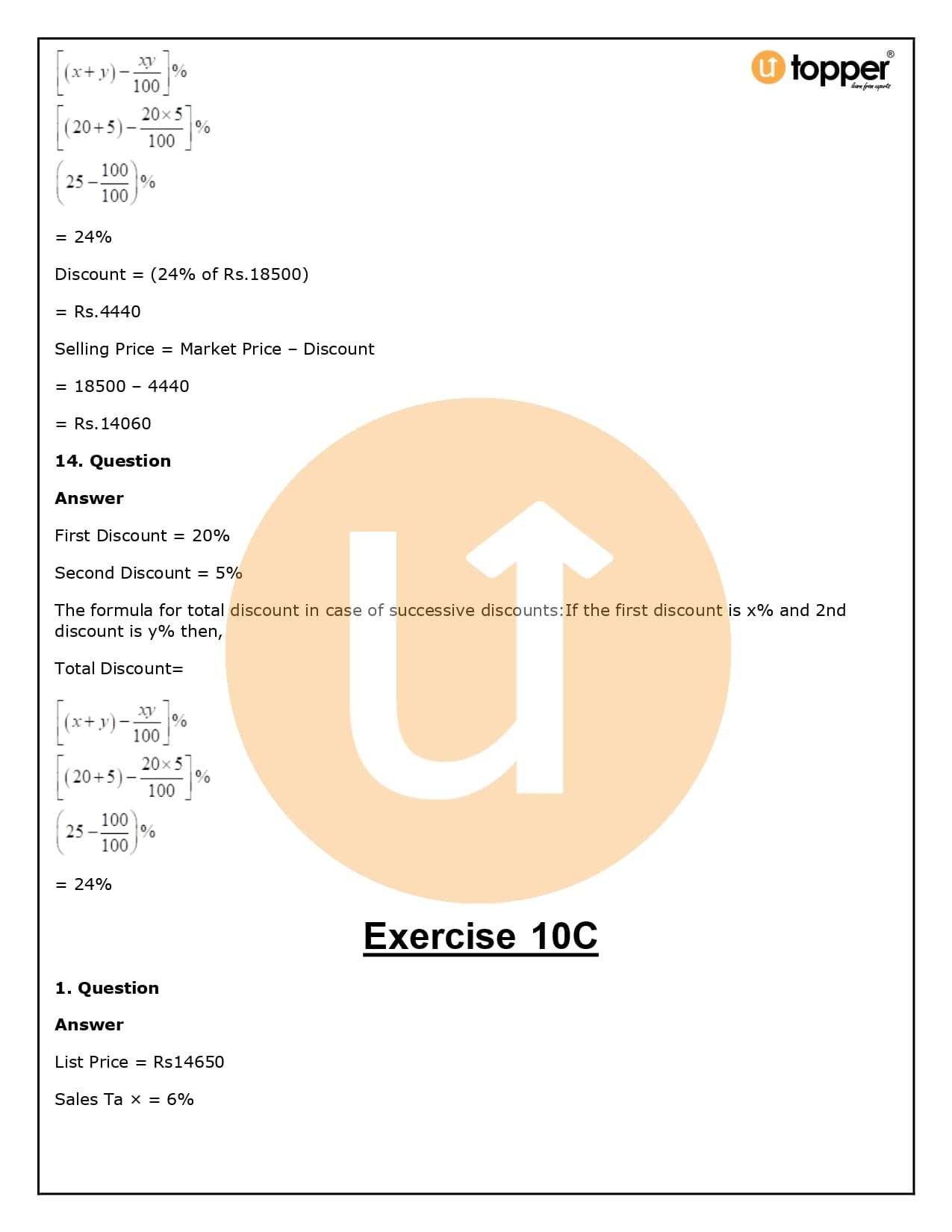

Marked Price is the price that is written on something. For example, if a store sells chairs and puts a price tag on each one, this is a form of advertising. Then, that price is known as the chair’s marked price. A product’s selling price and its marked price might not be the same. The shopkeeper might sometimes take a discount off the price written on the item, so the price at which the item is sold might be different than the price written on the item.

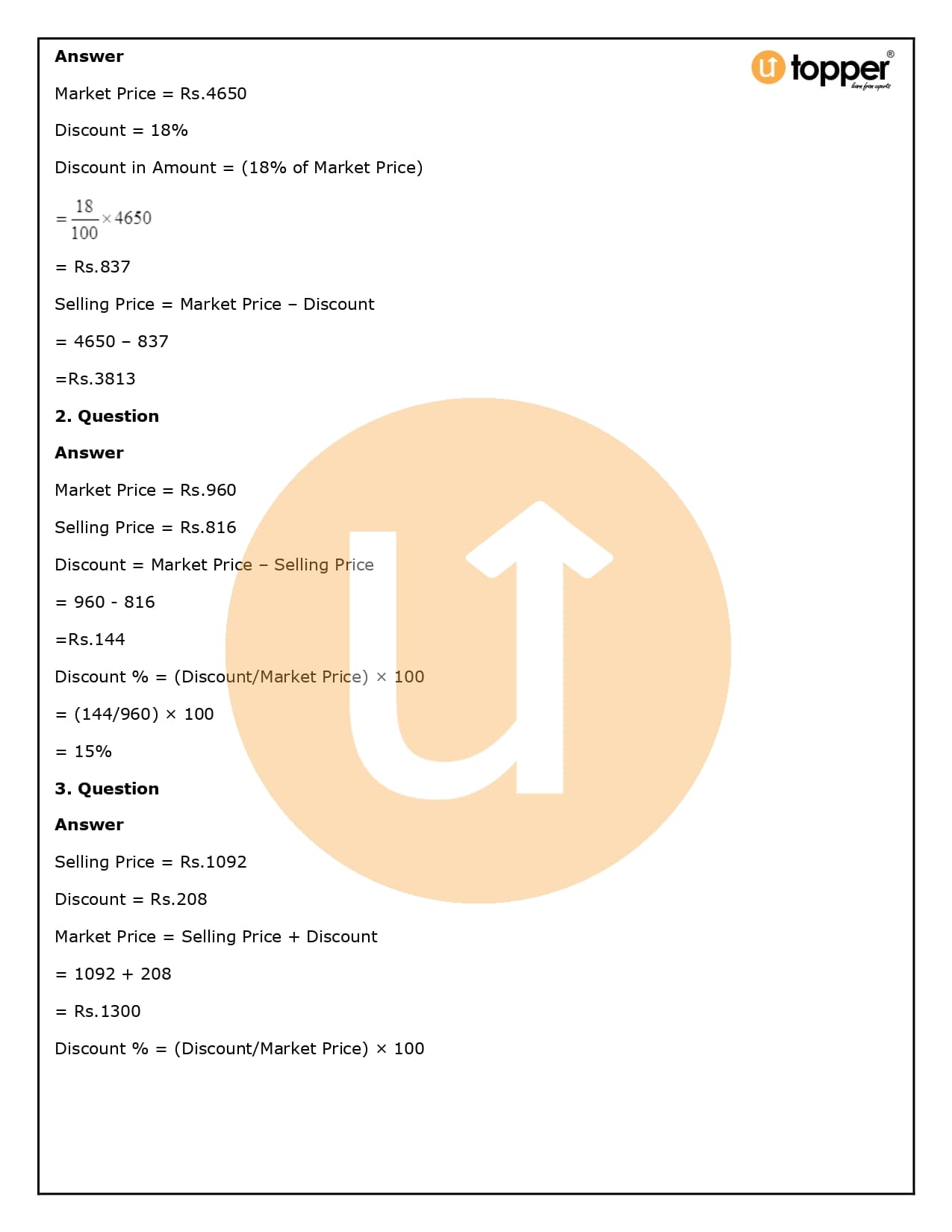

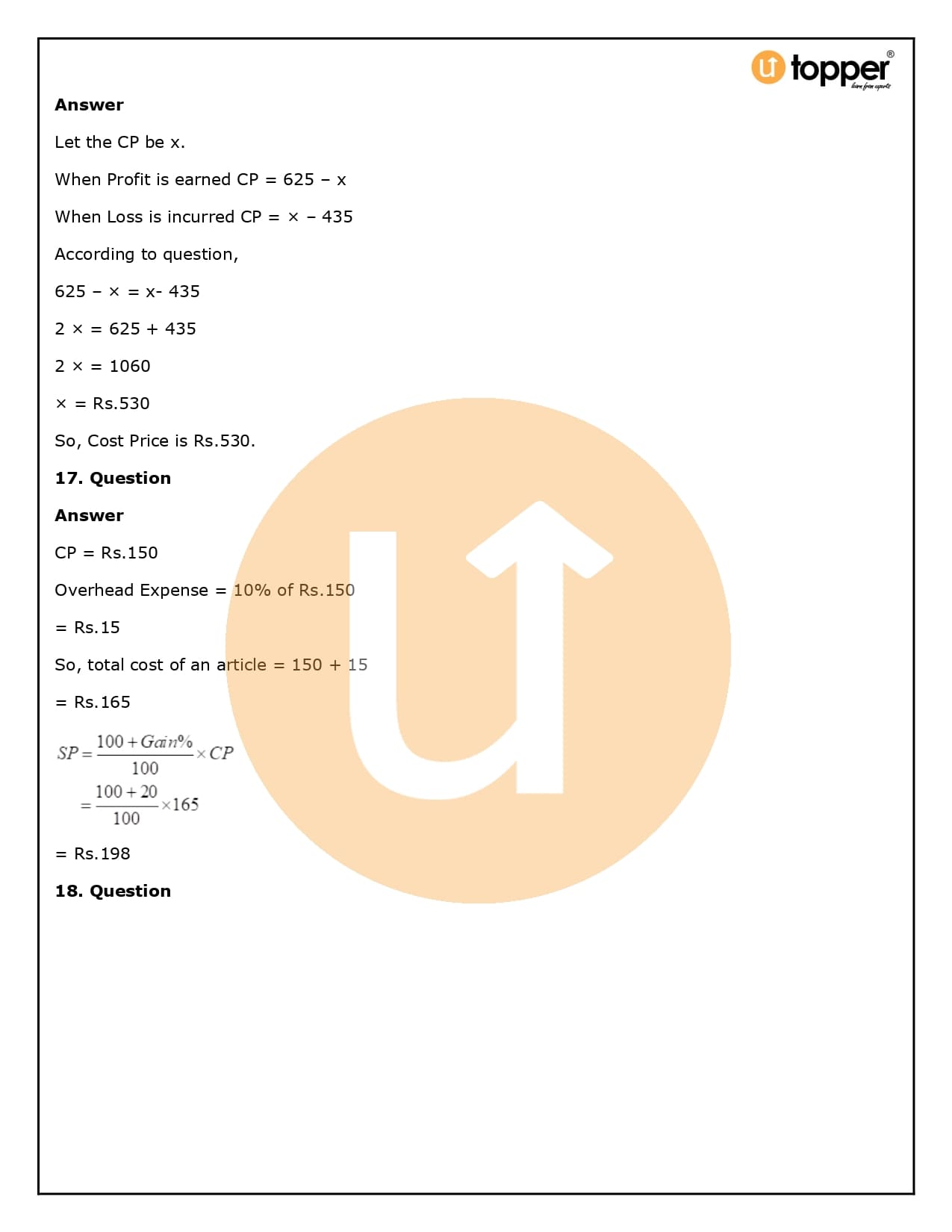

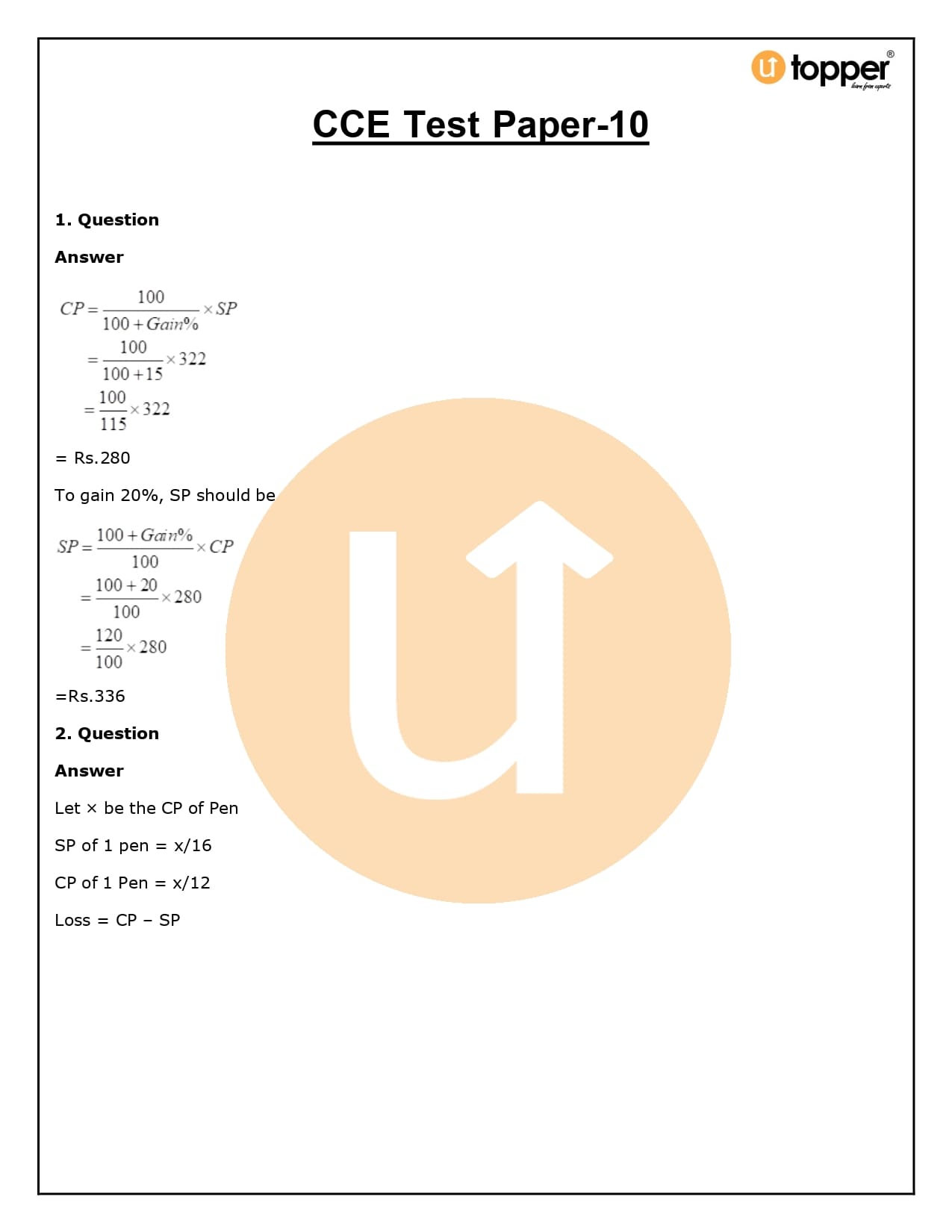

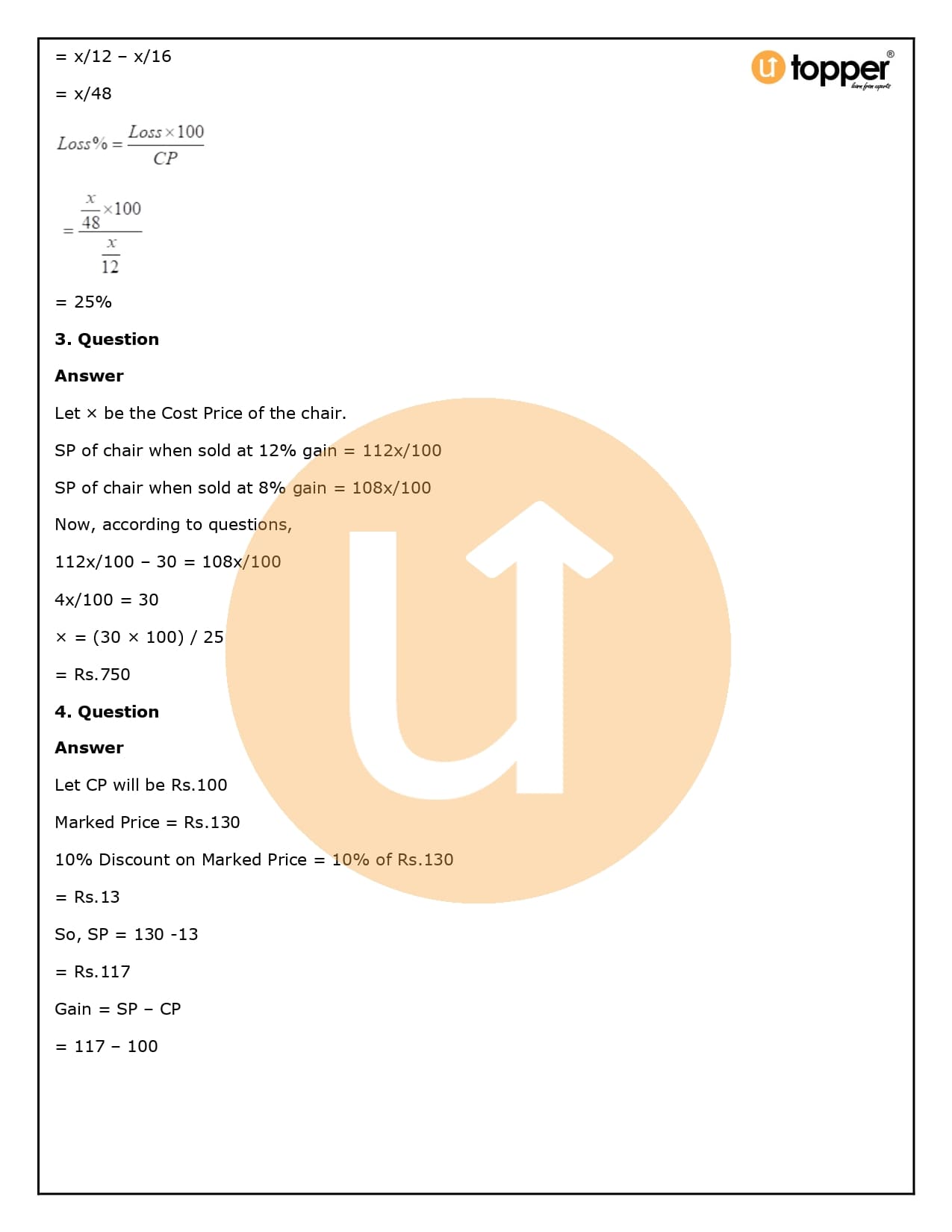

Computing the Cost Price

- If we know the Selling Price of an item and profit from selling it, then,

- Cost Price = Selling Price – profit

- If we have the Selling Price of an article and loss on its selling then,

- Cost Price = Selling Price + Loss

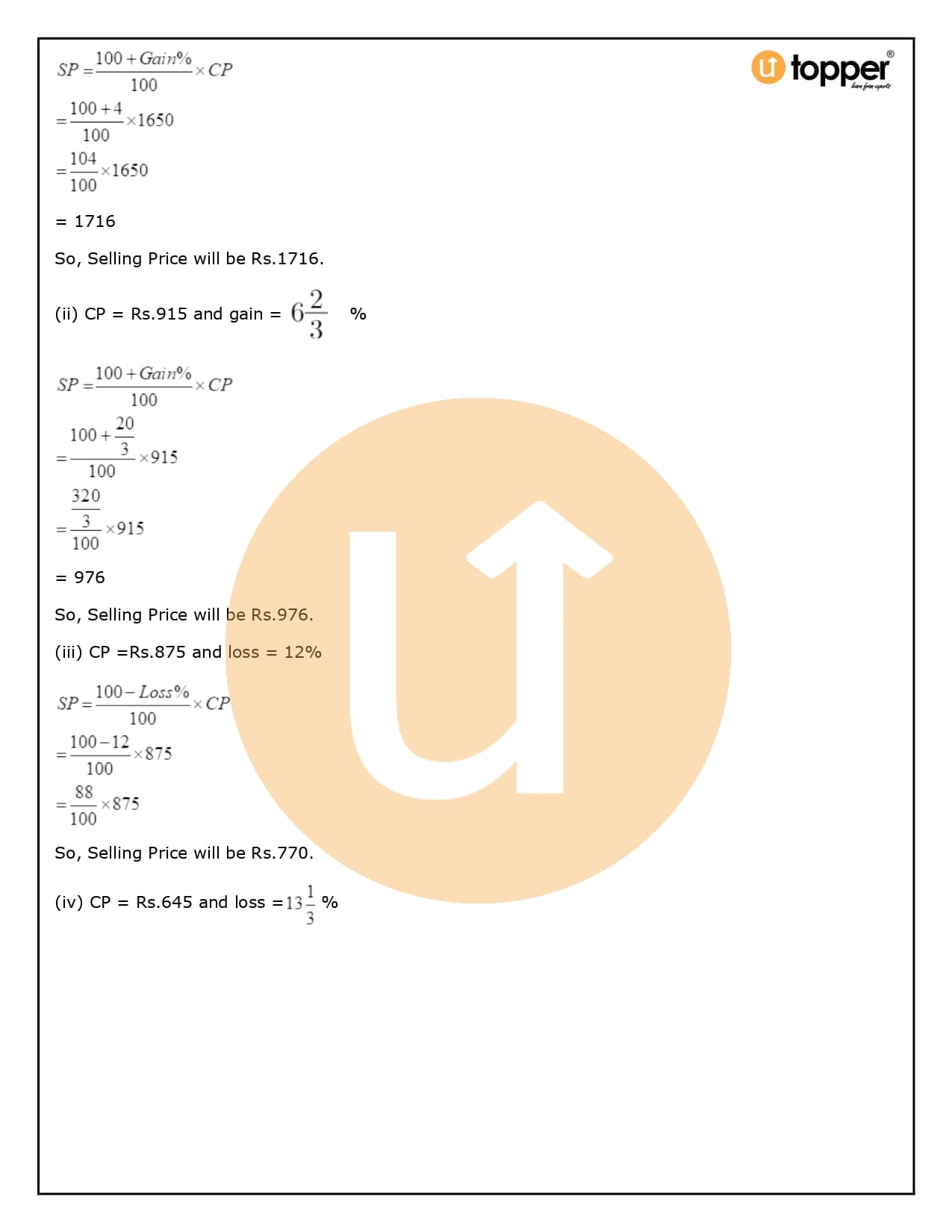

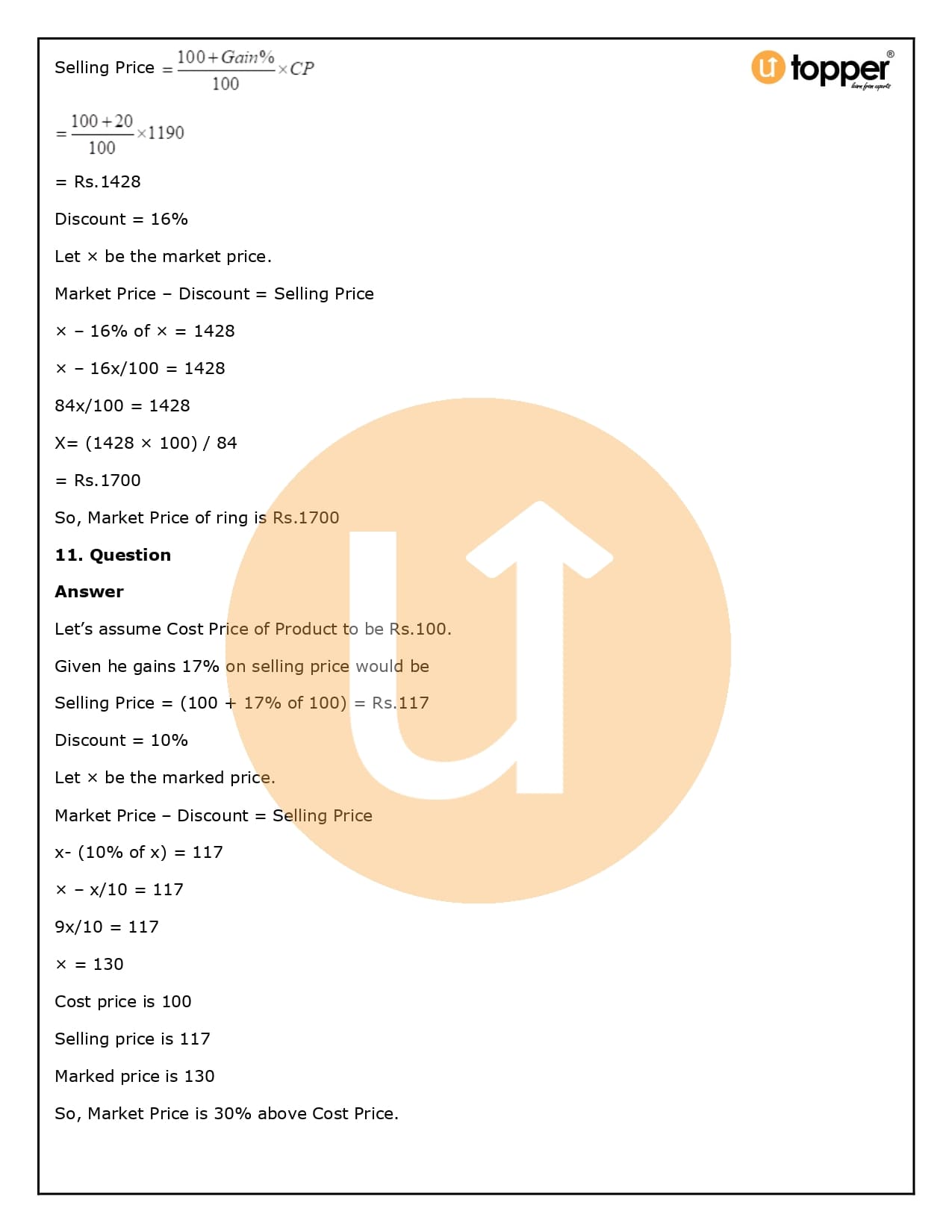

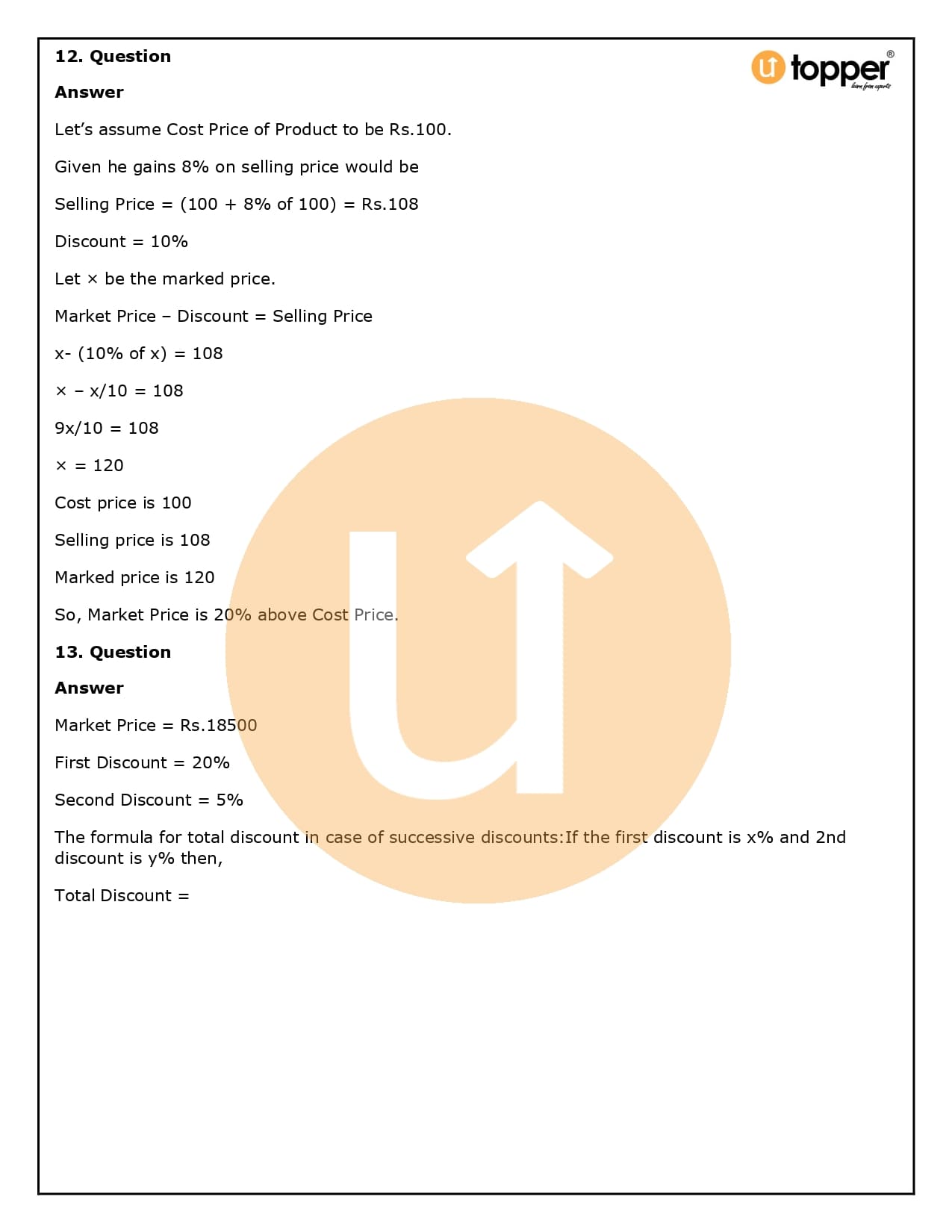

Computing the Selling Price

If you know the item’s Cost Price and how much profit when it was sold, you can figure out its Selling Price by adding its Cost Price and its profit.

- Selling Price = Cost Price + Profit

- If we have the Cost Price of an article and loss on its selling then,

- Selling Price = Cost Price – Loss

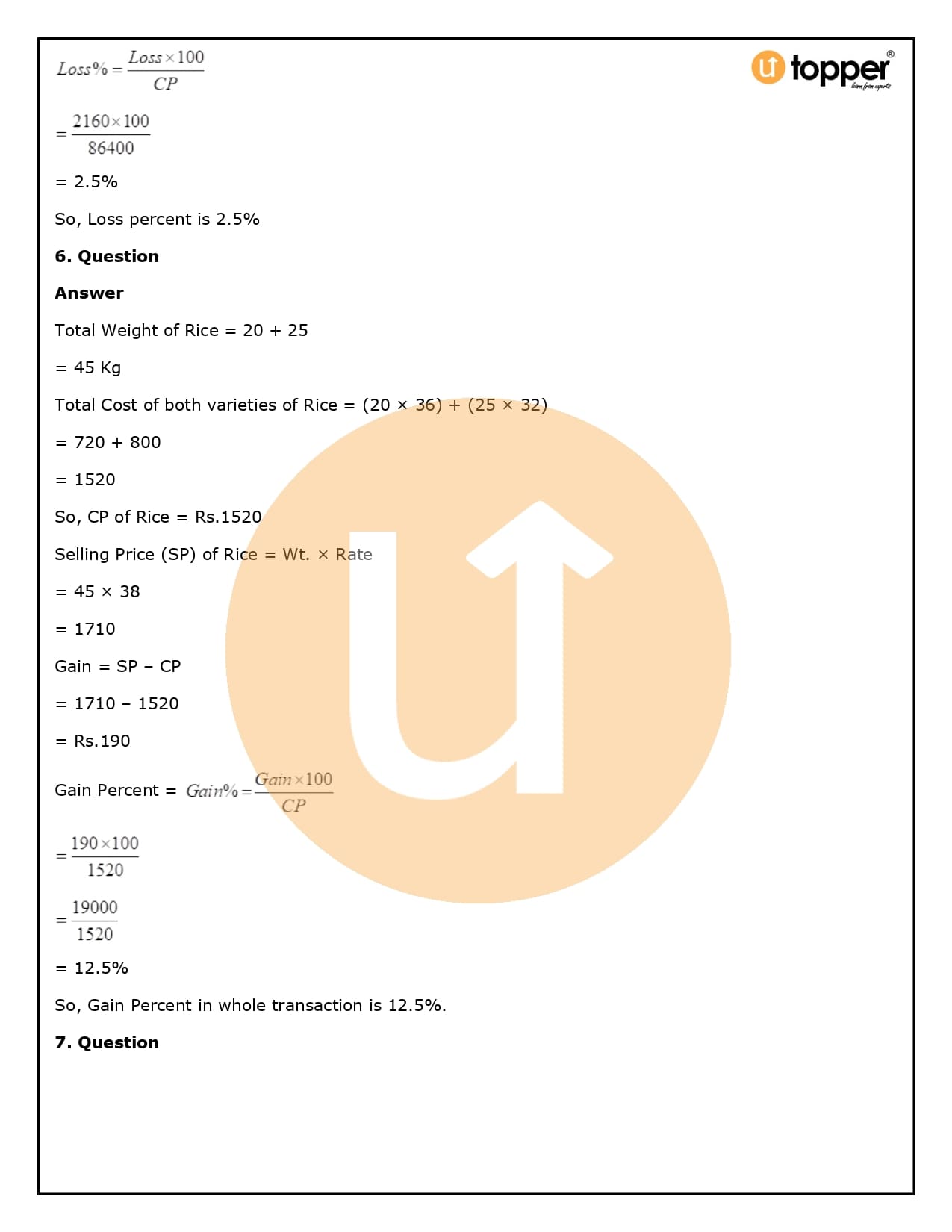

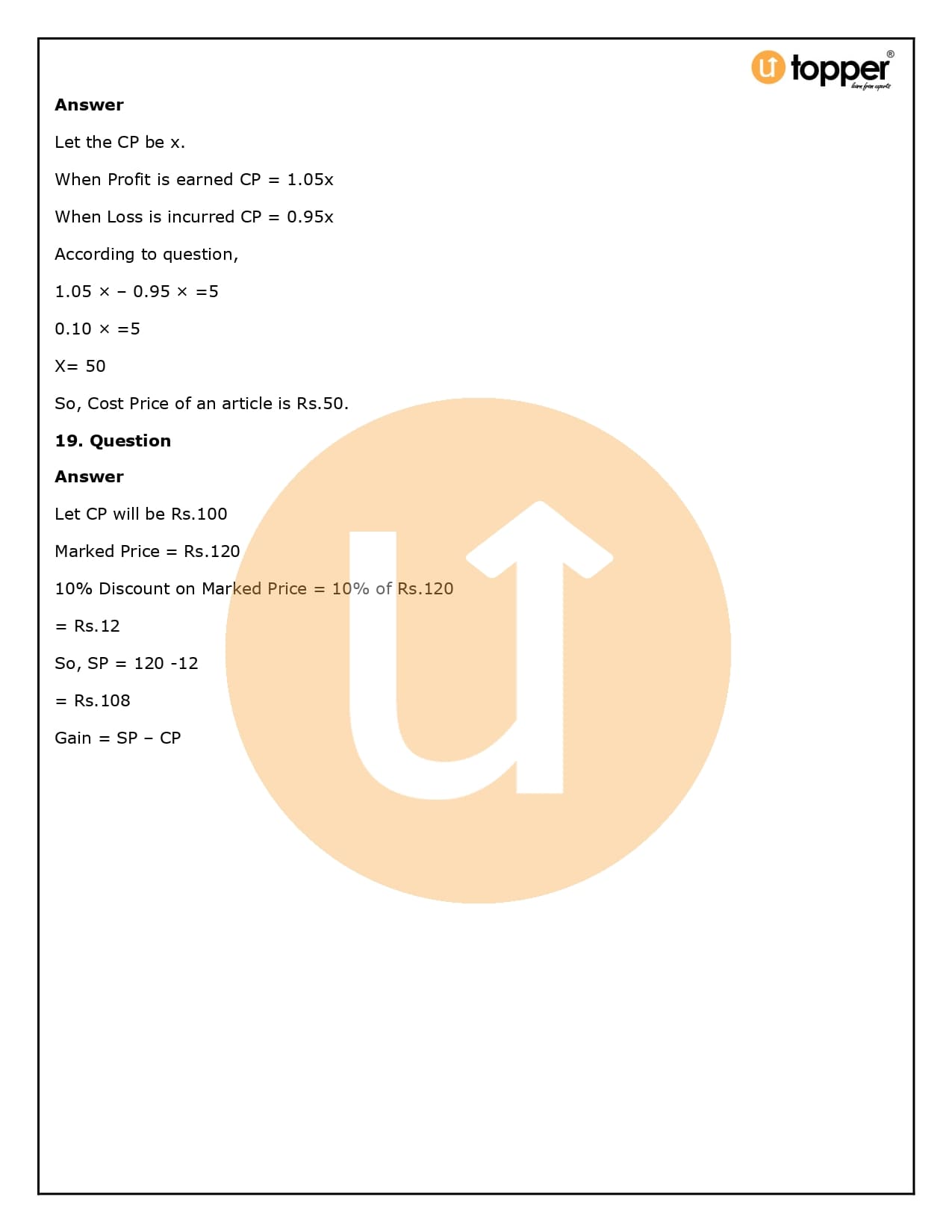

What is a profit and what is a loss?

Profit is simply the extra money a business owner makes when the selling price is higher than the cost price.

- When S.P > C. P

- S.P – C.P = Profit

- When someone sells an item for less than what they bought it for or what it cost them, they have made a loss.

- When C.P > S.P

- C.P – S.P = Loss

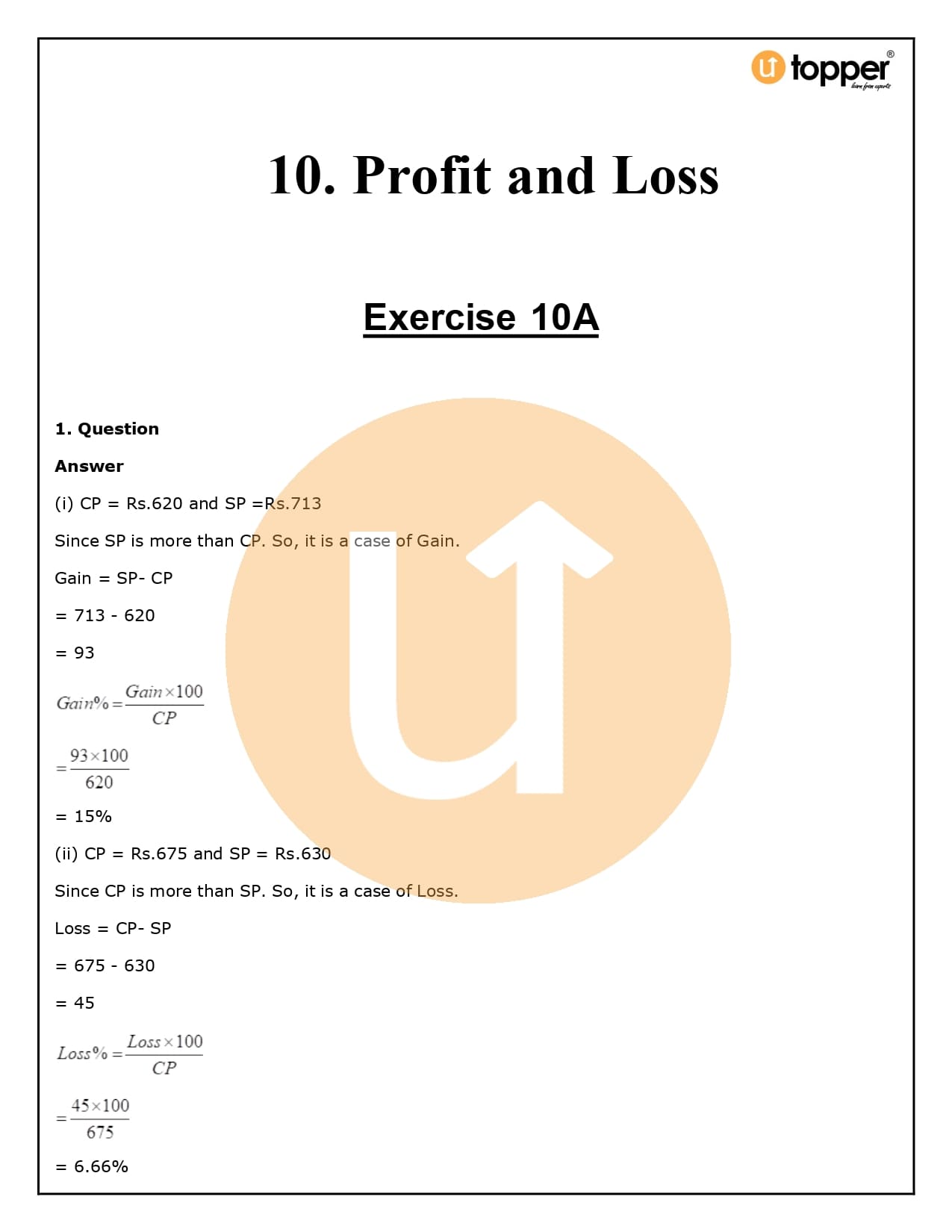

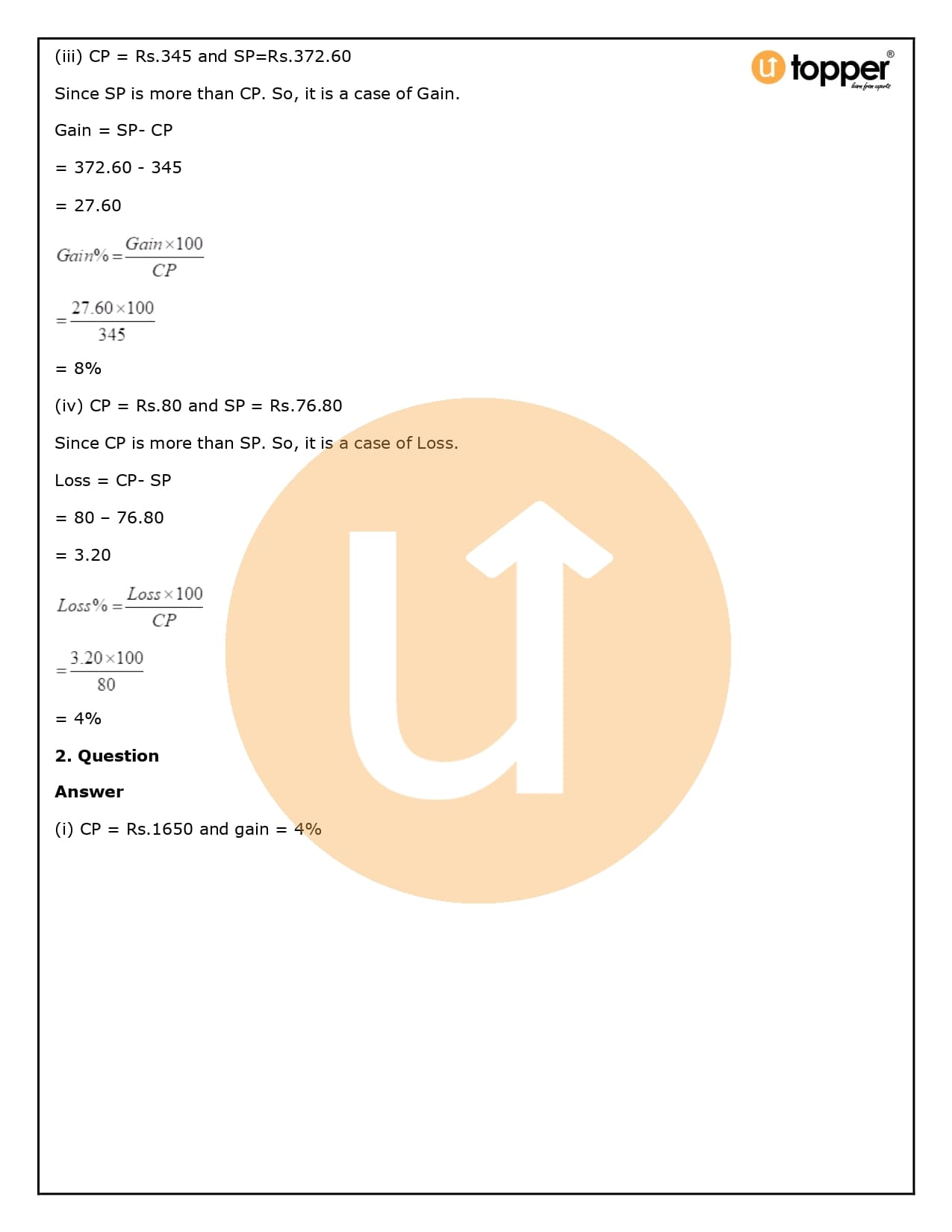

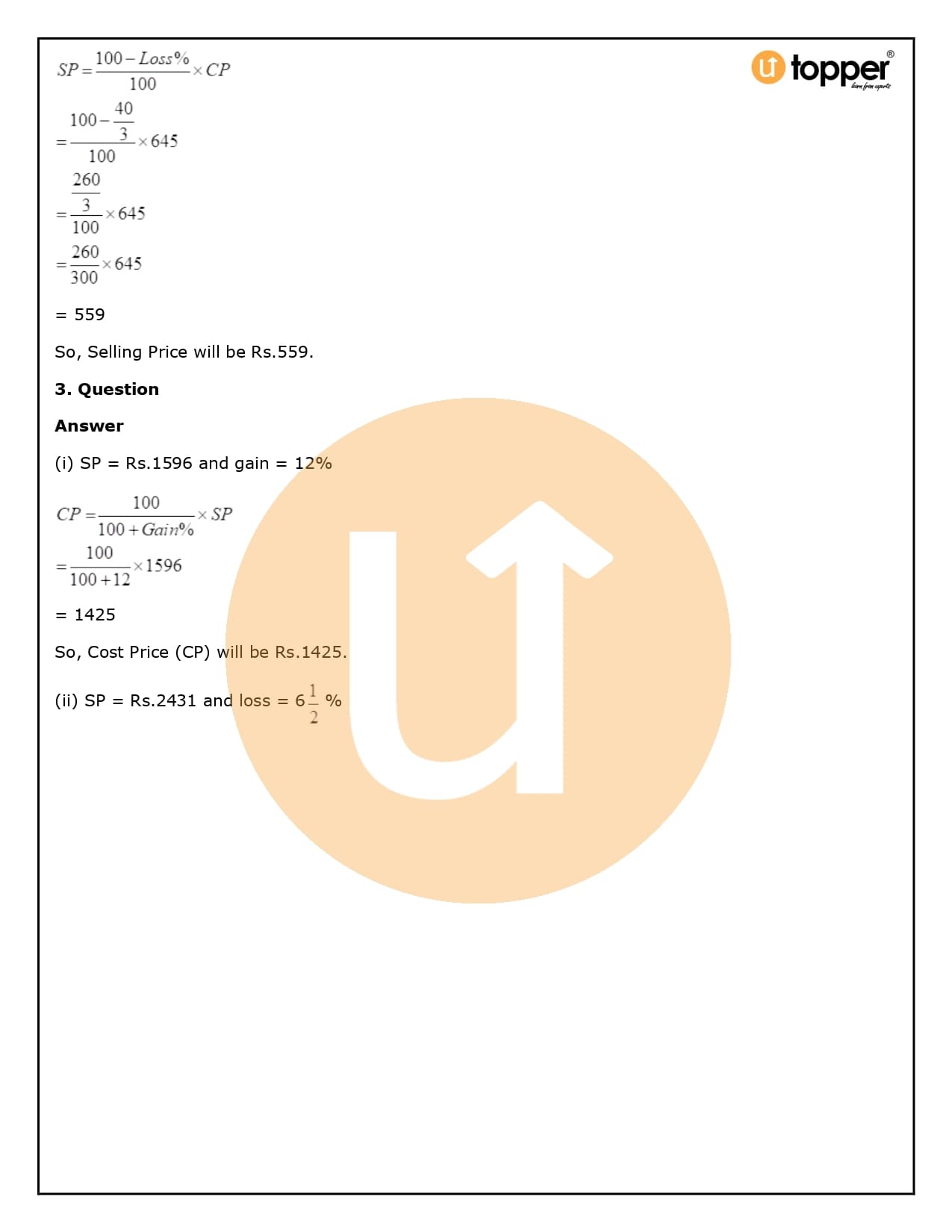

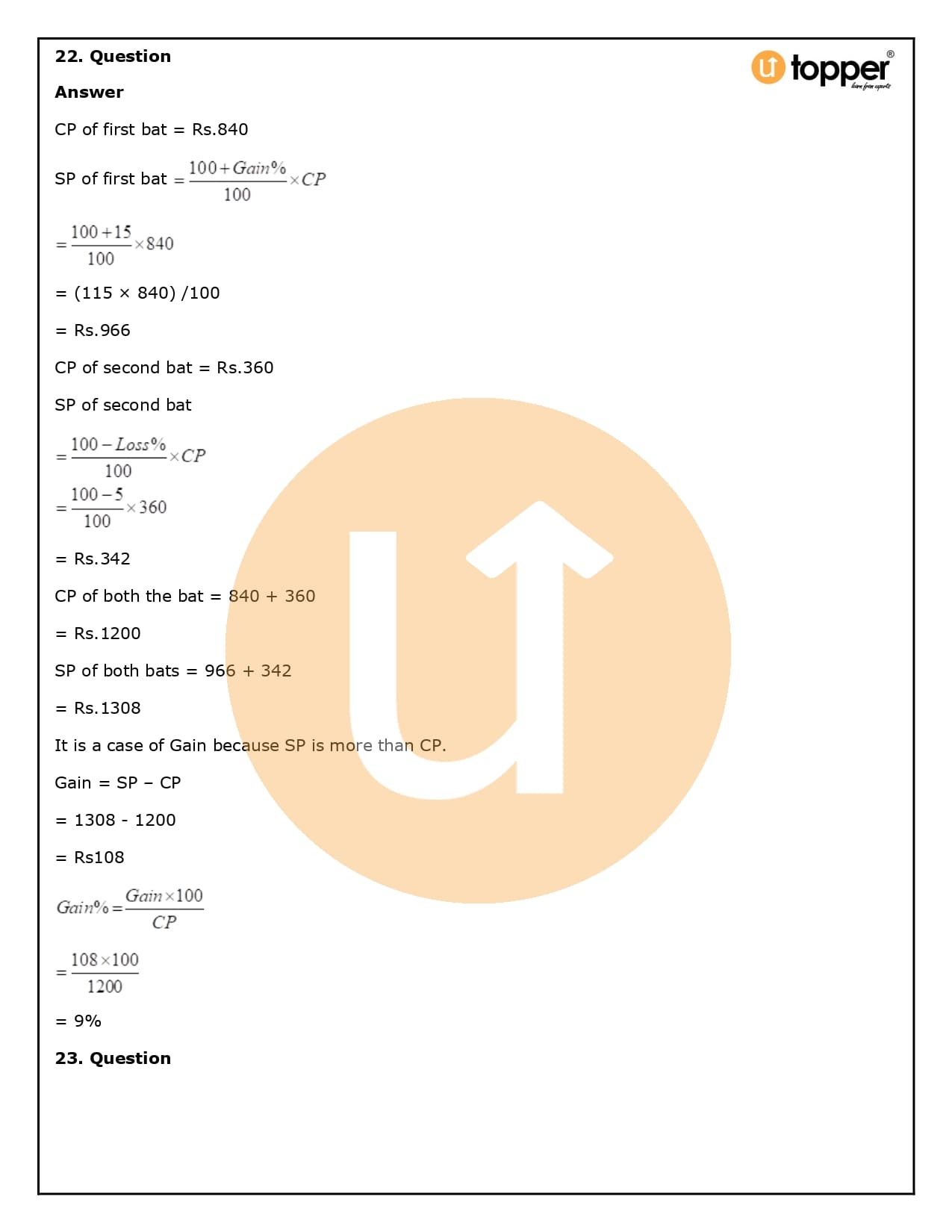

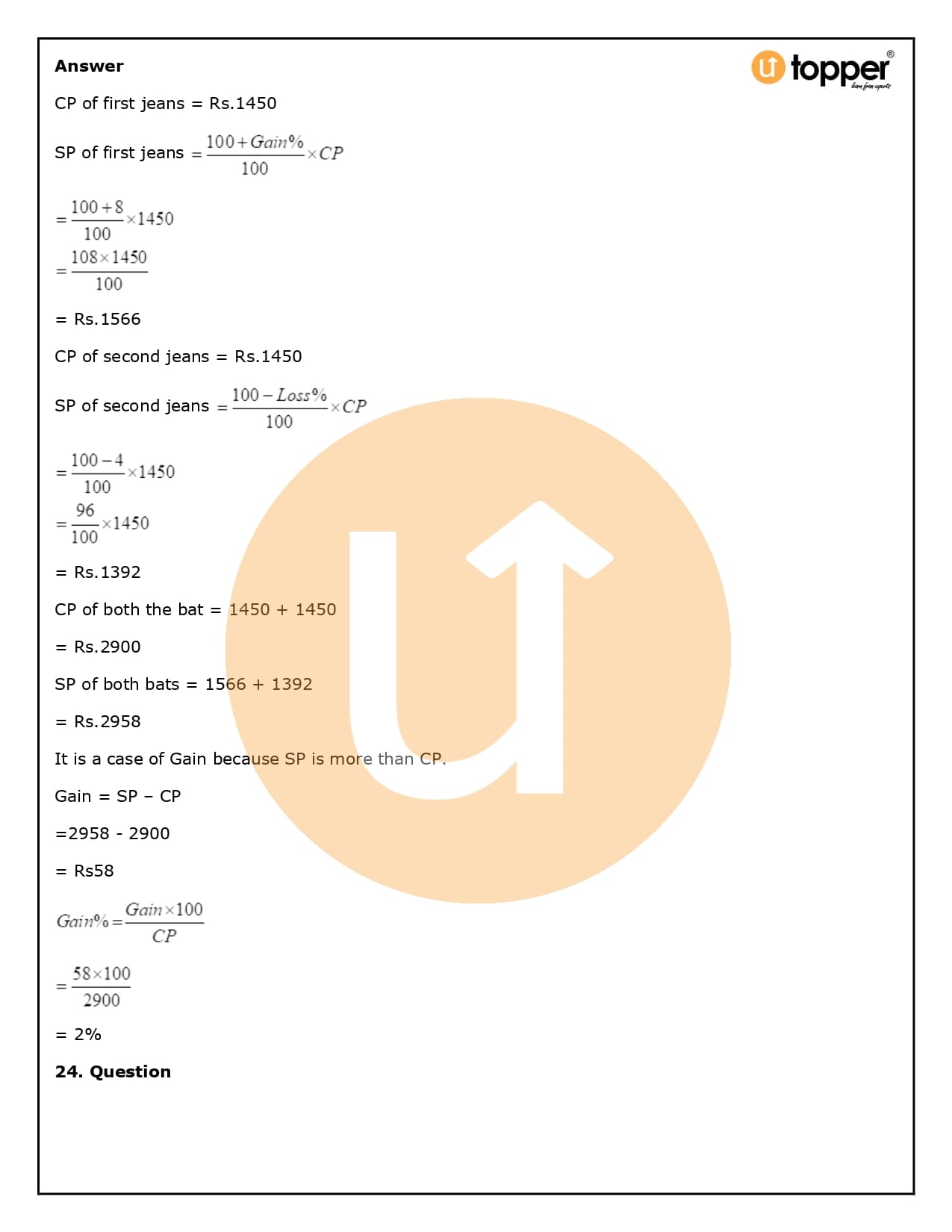

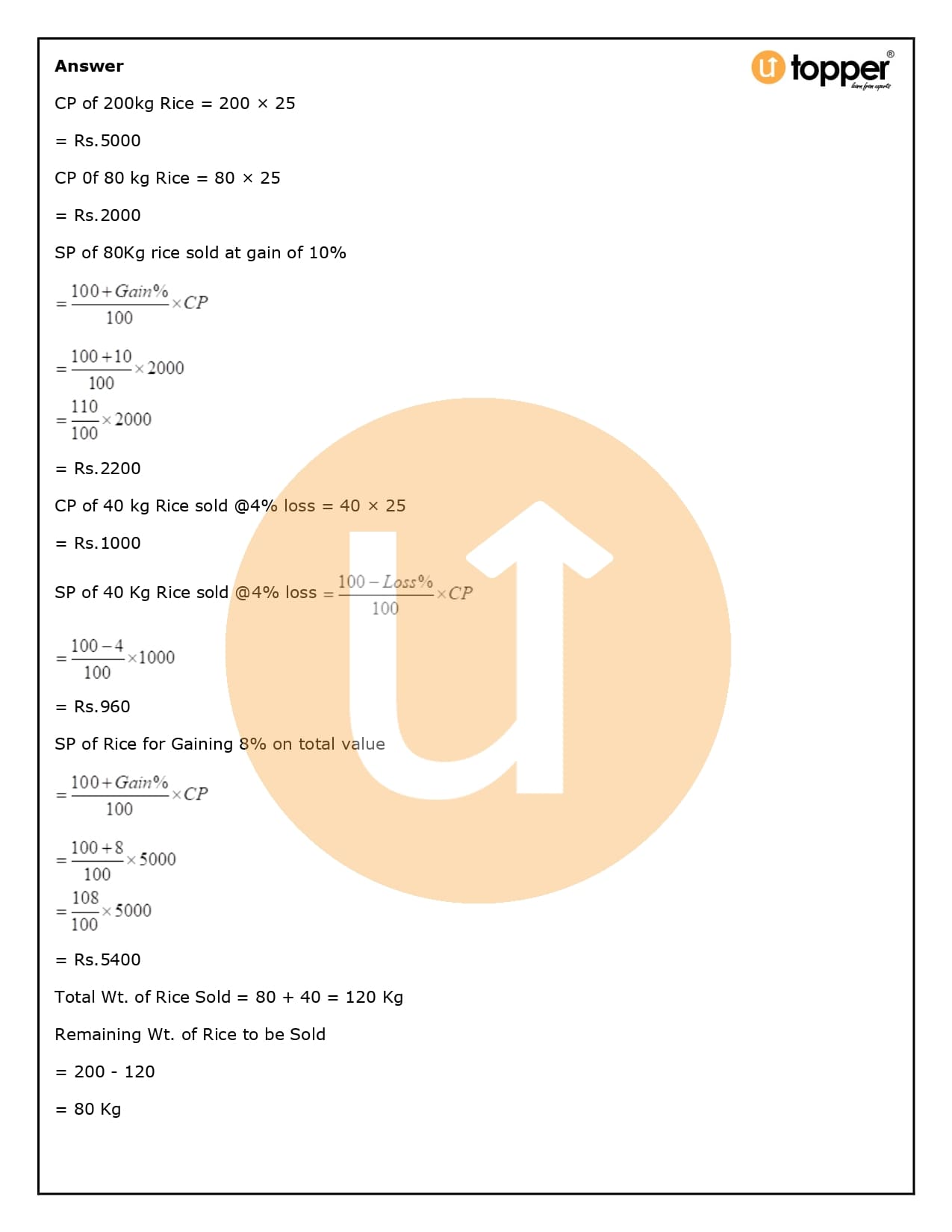

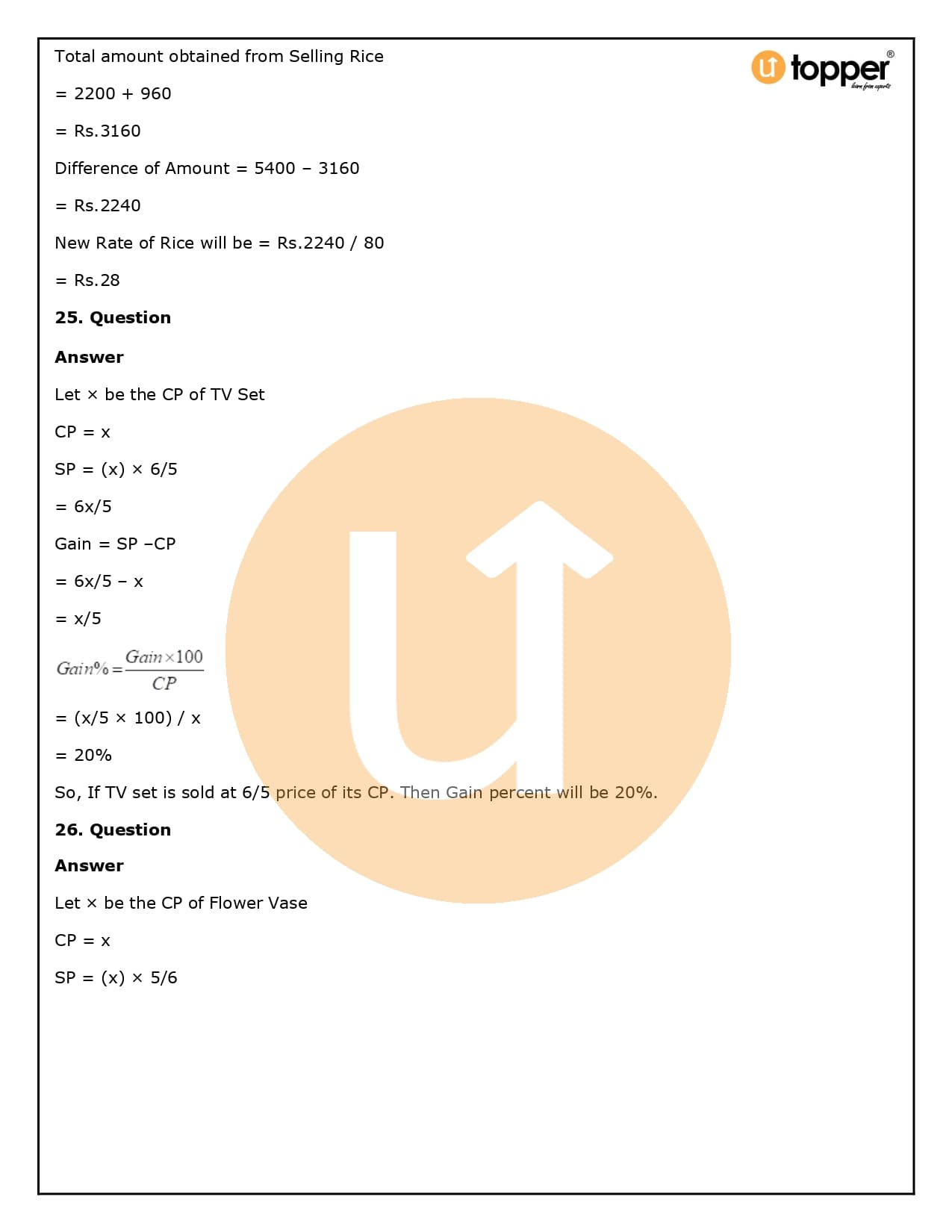

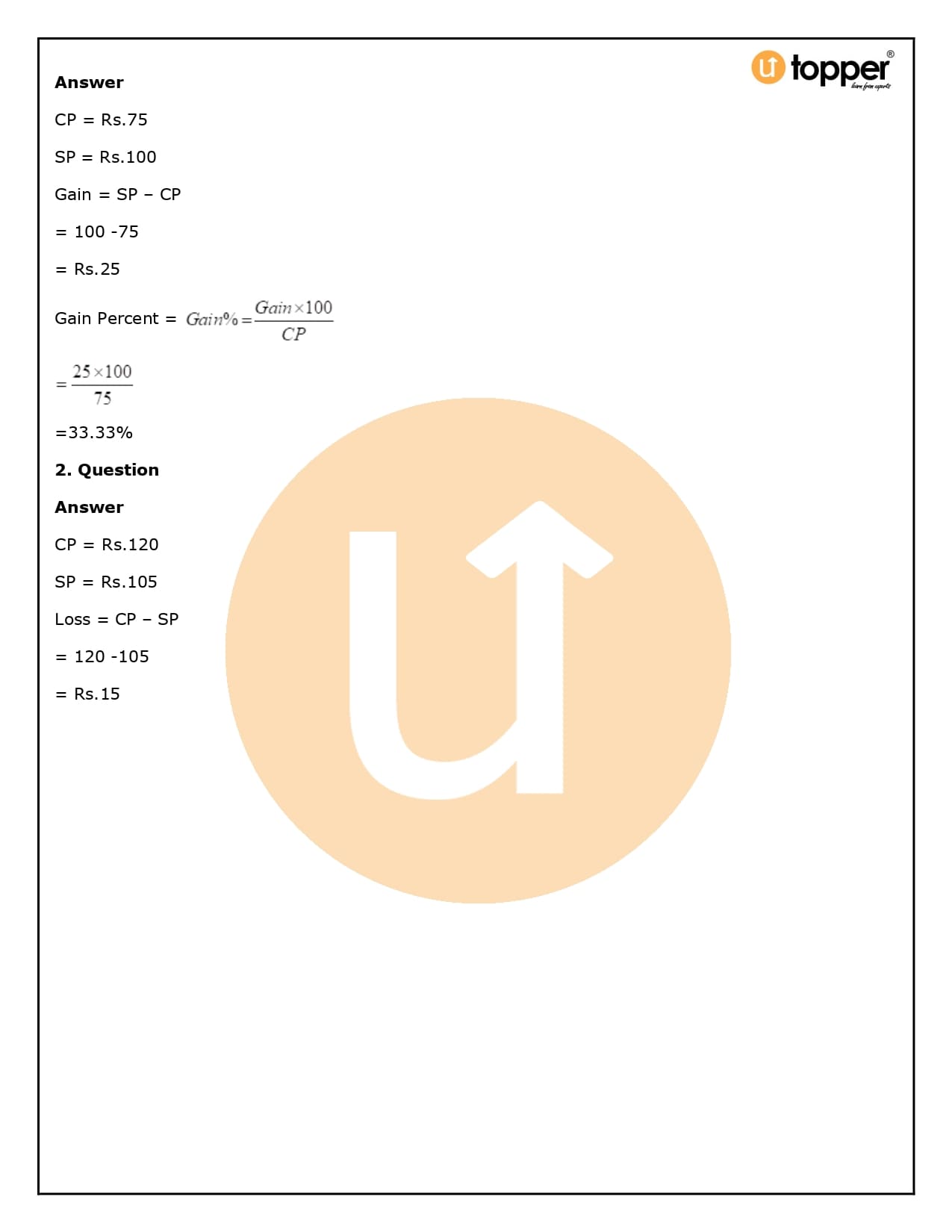

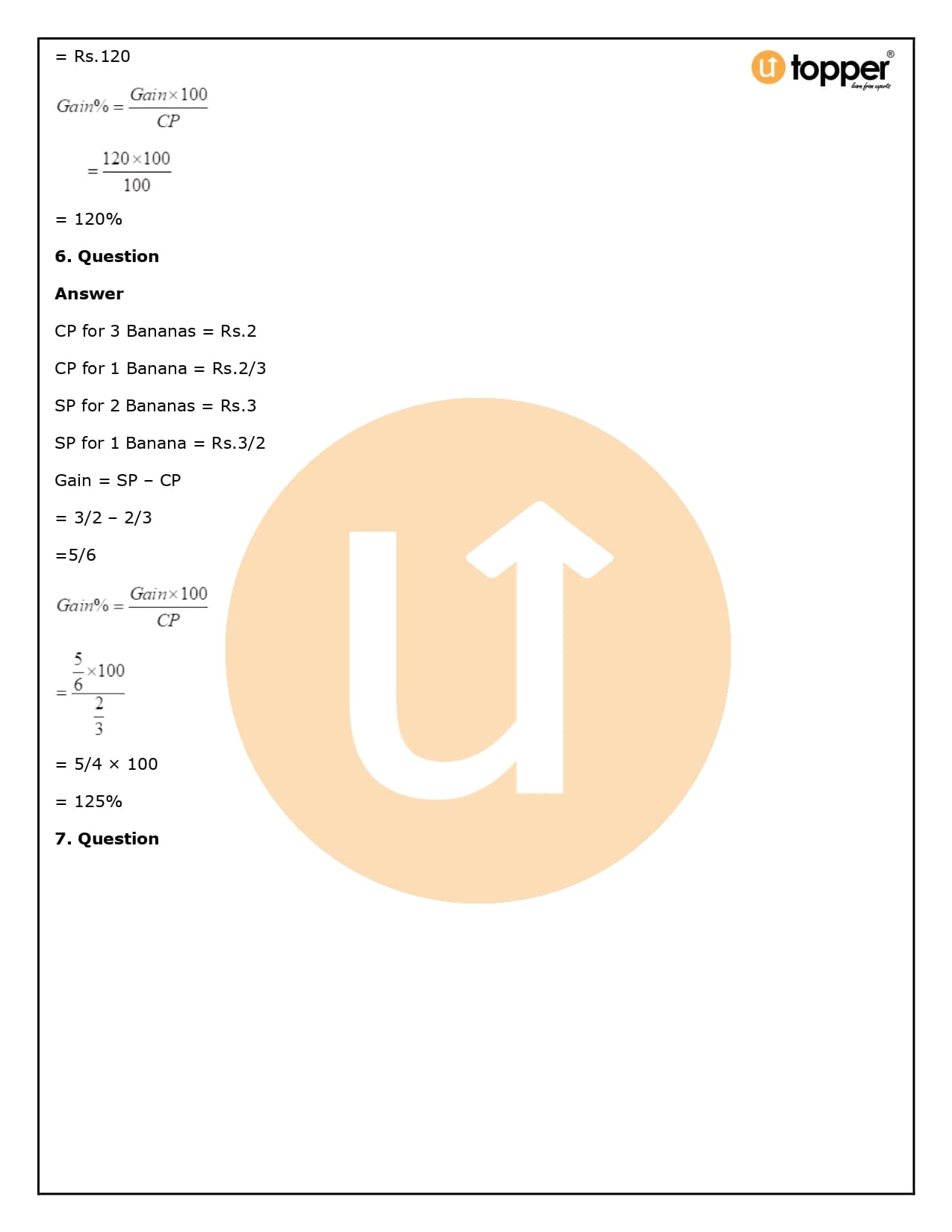

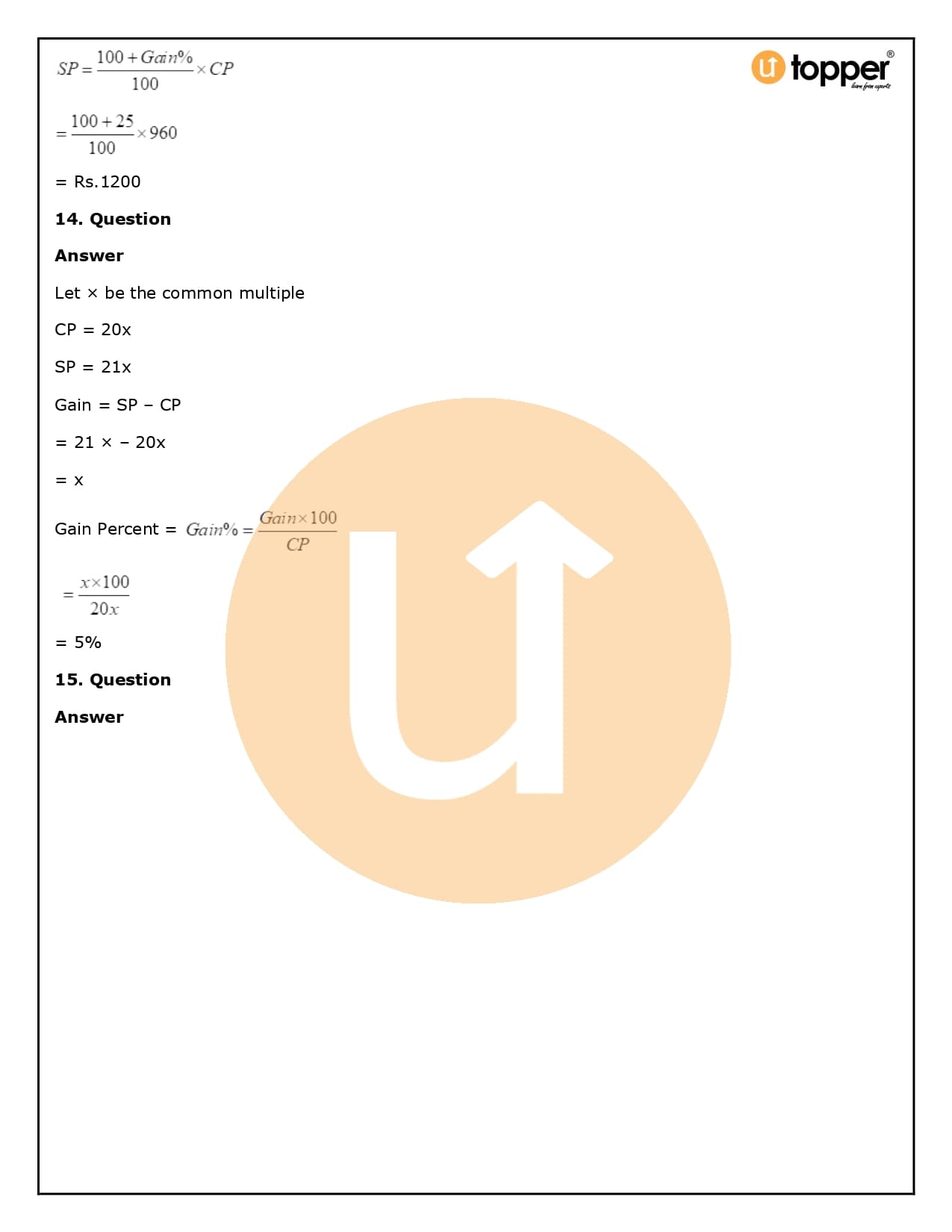

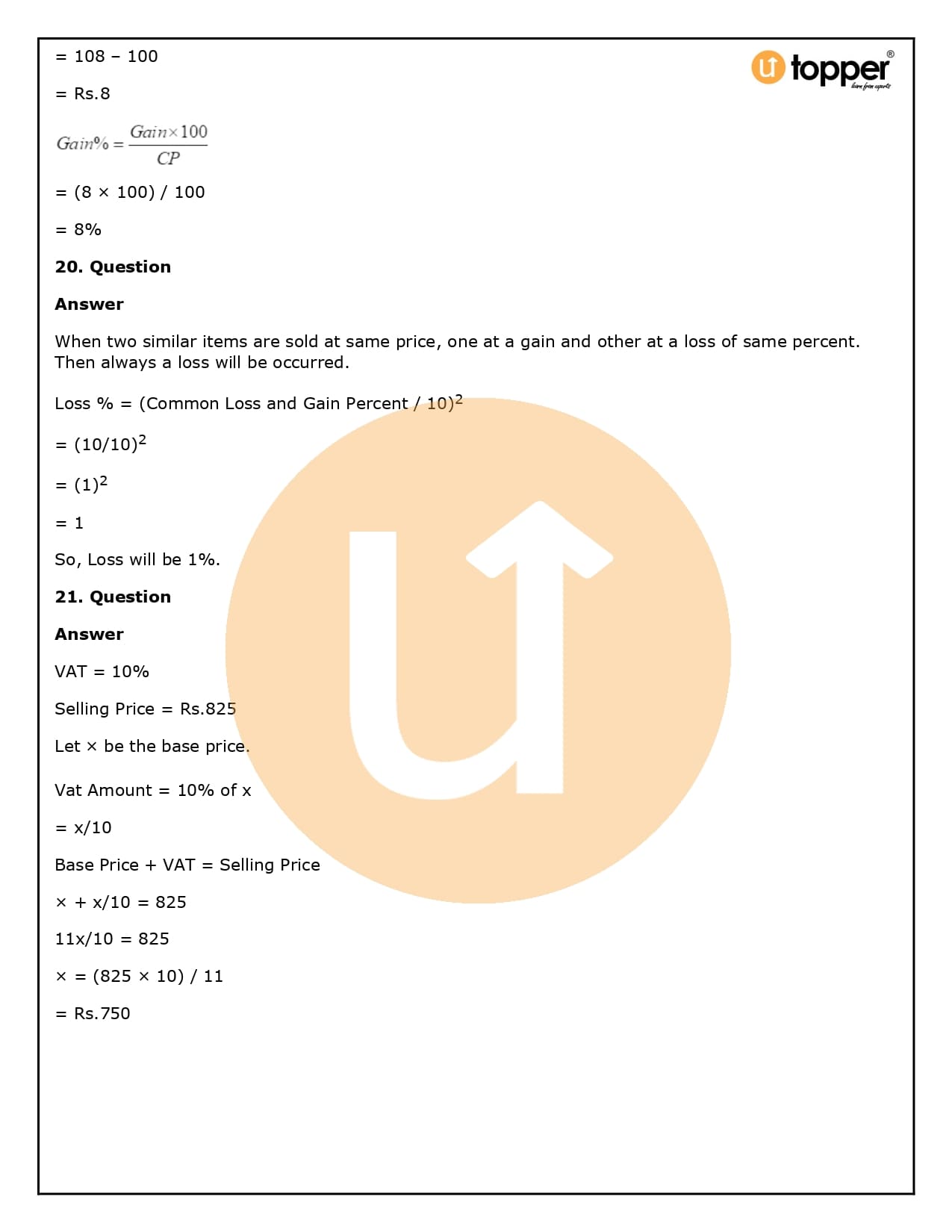

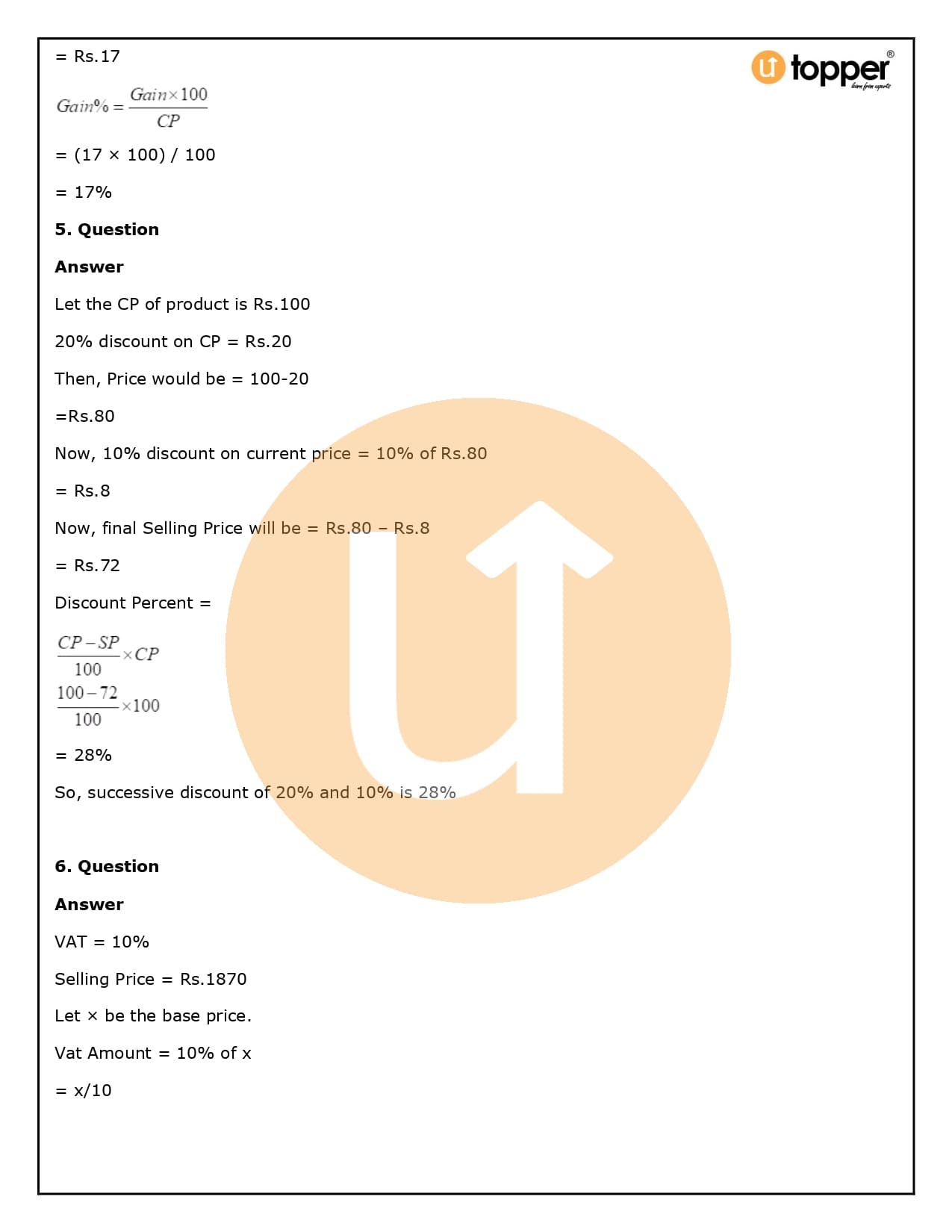

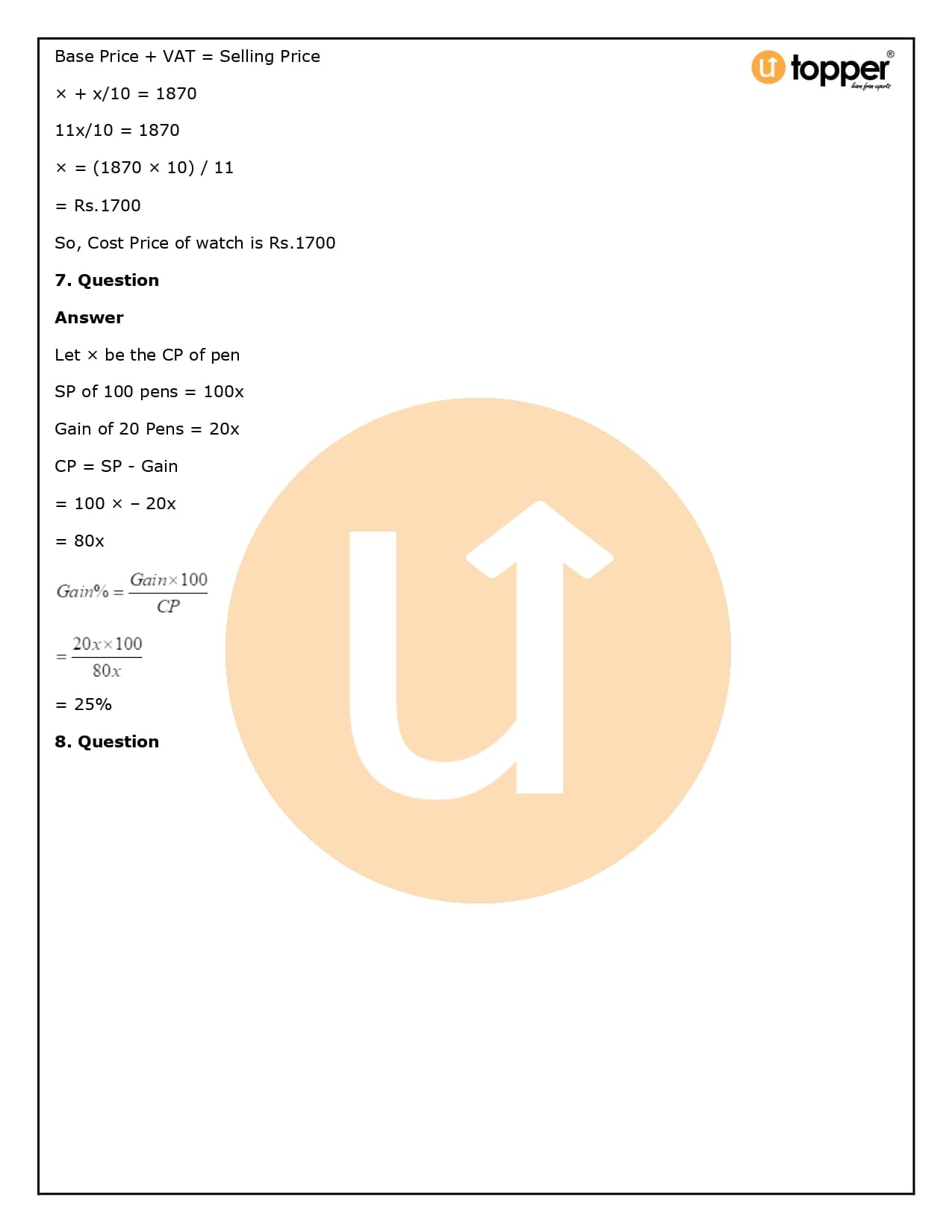

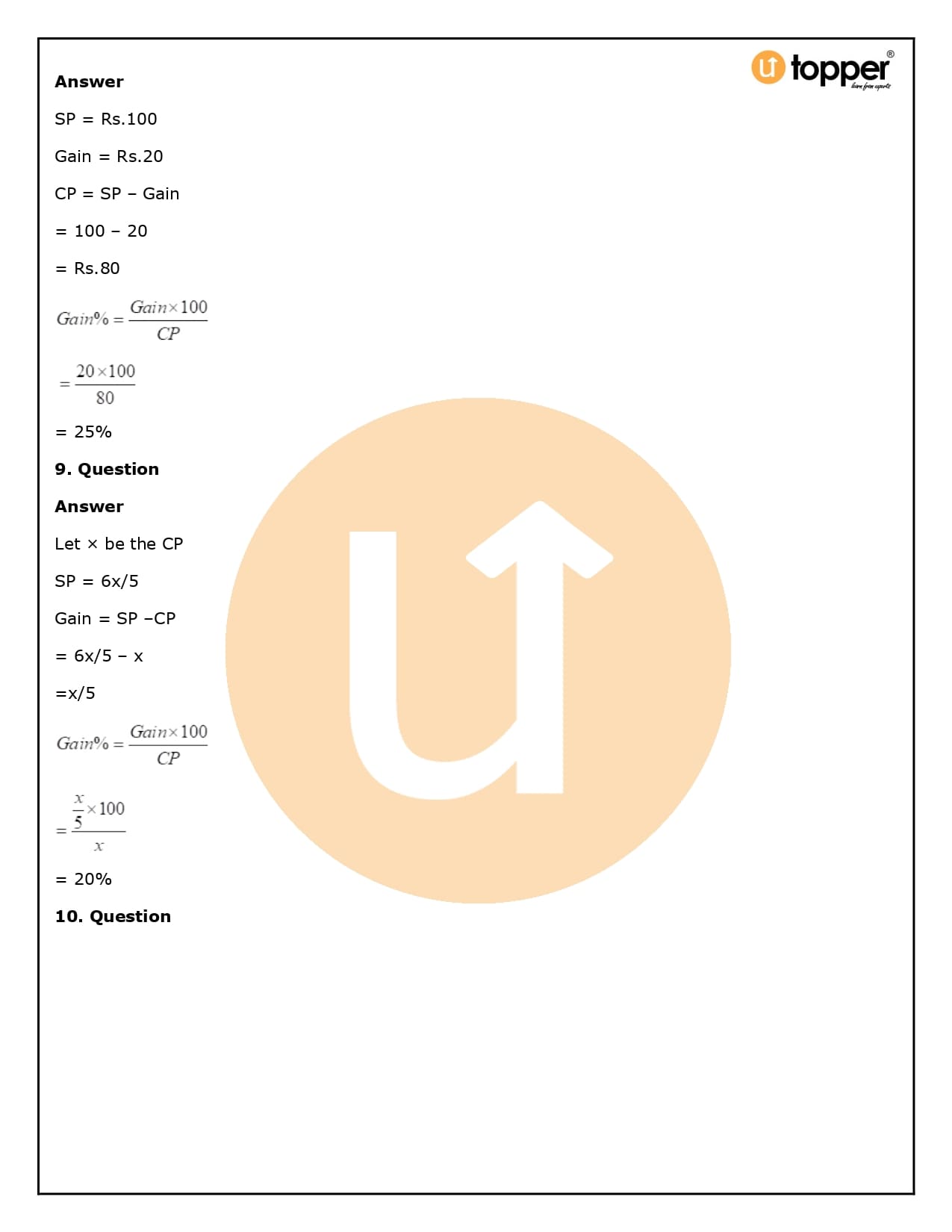

How to Figure Out the Profit Percentage

The formula makes it easy to figure out the percentage of profit.

- Profit % = (Profit/C.P x 100)%

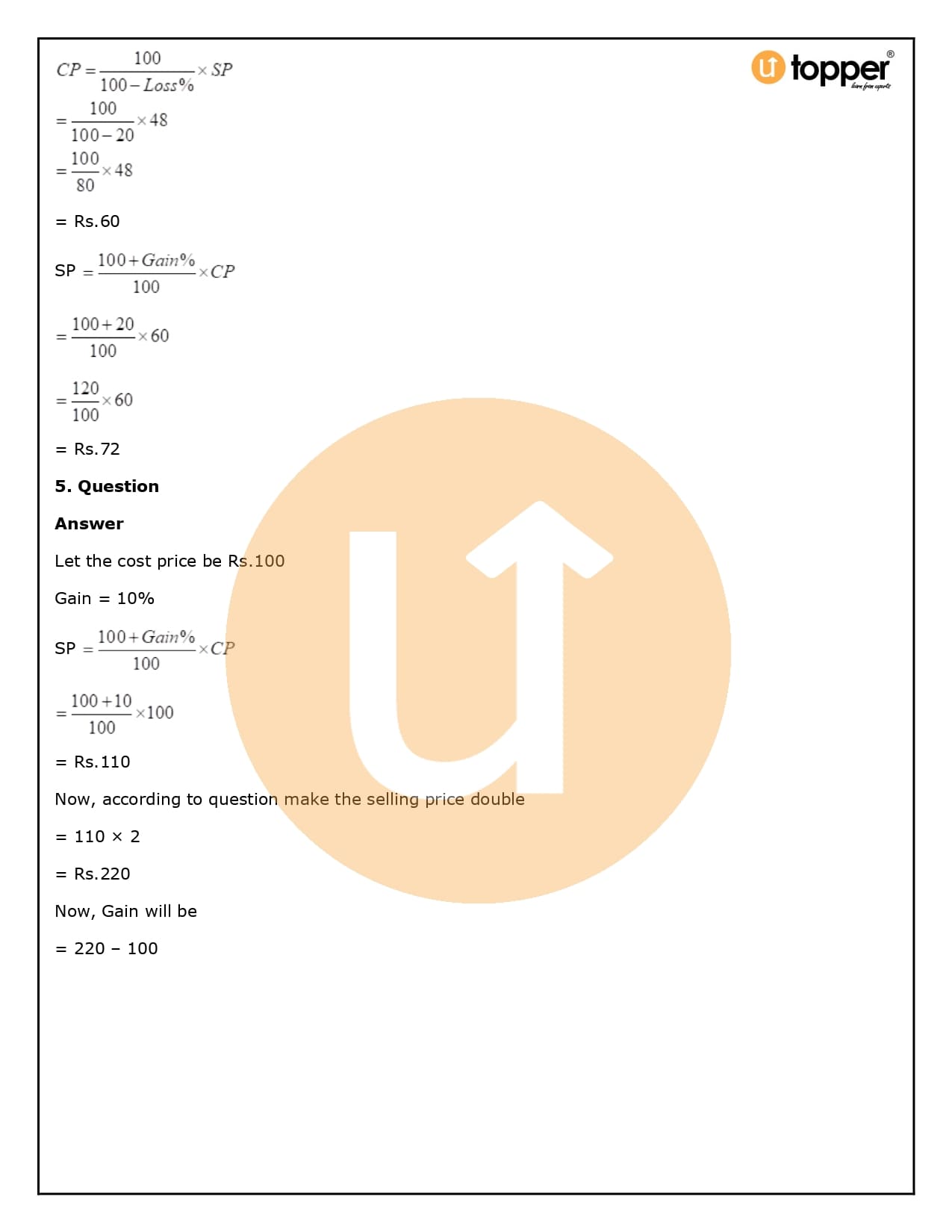

With the information given, you can also figure out the selling price and the cost price. The formula is,

- Selling Price = (100 + Profit%) / 100 × CP

- Cost Price = 100/ (100 + gain %) × Cost Price

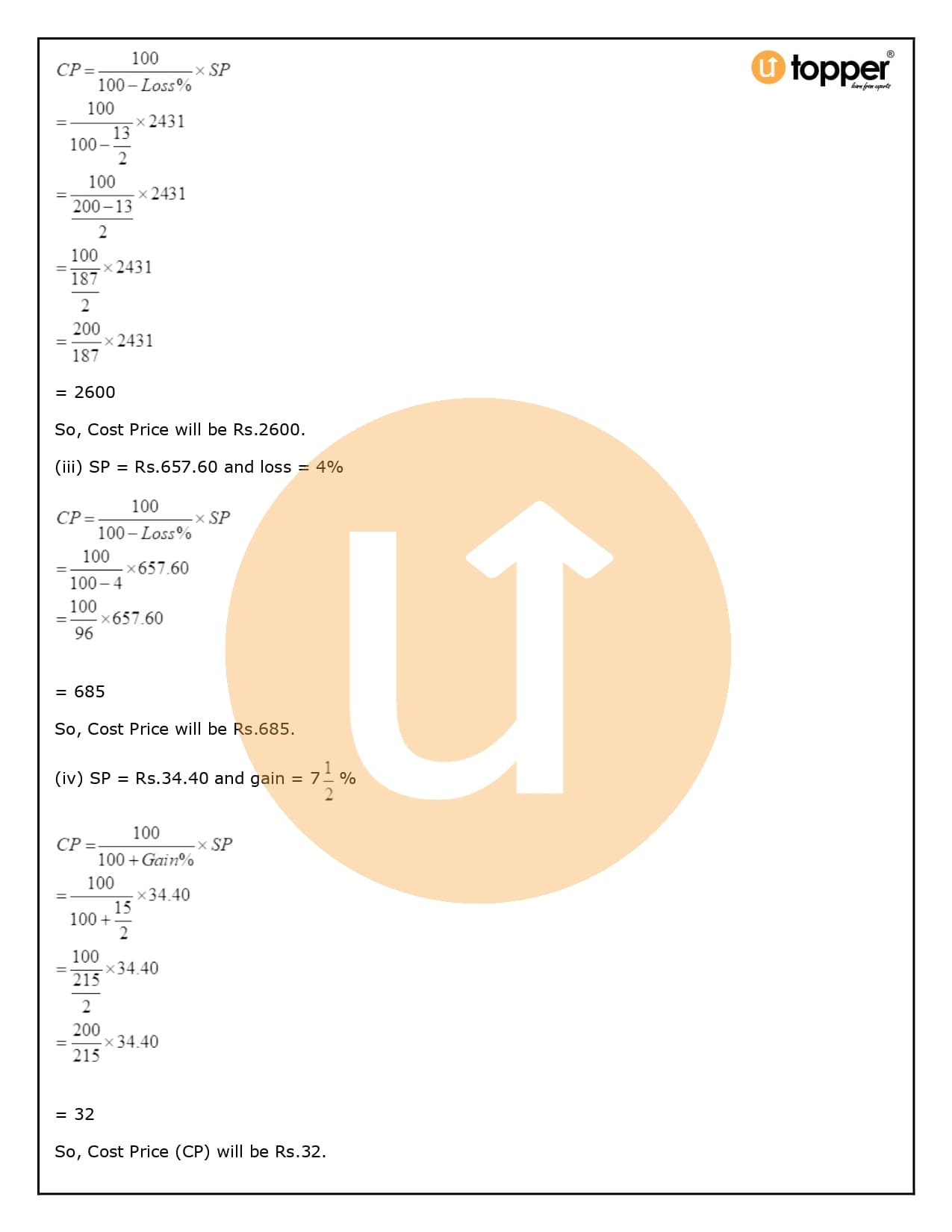

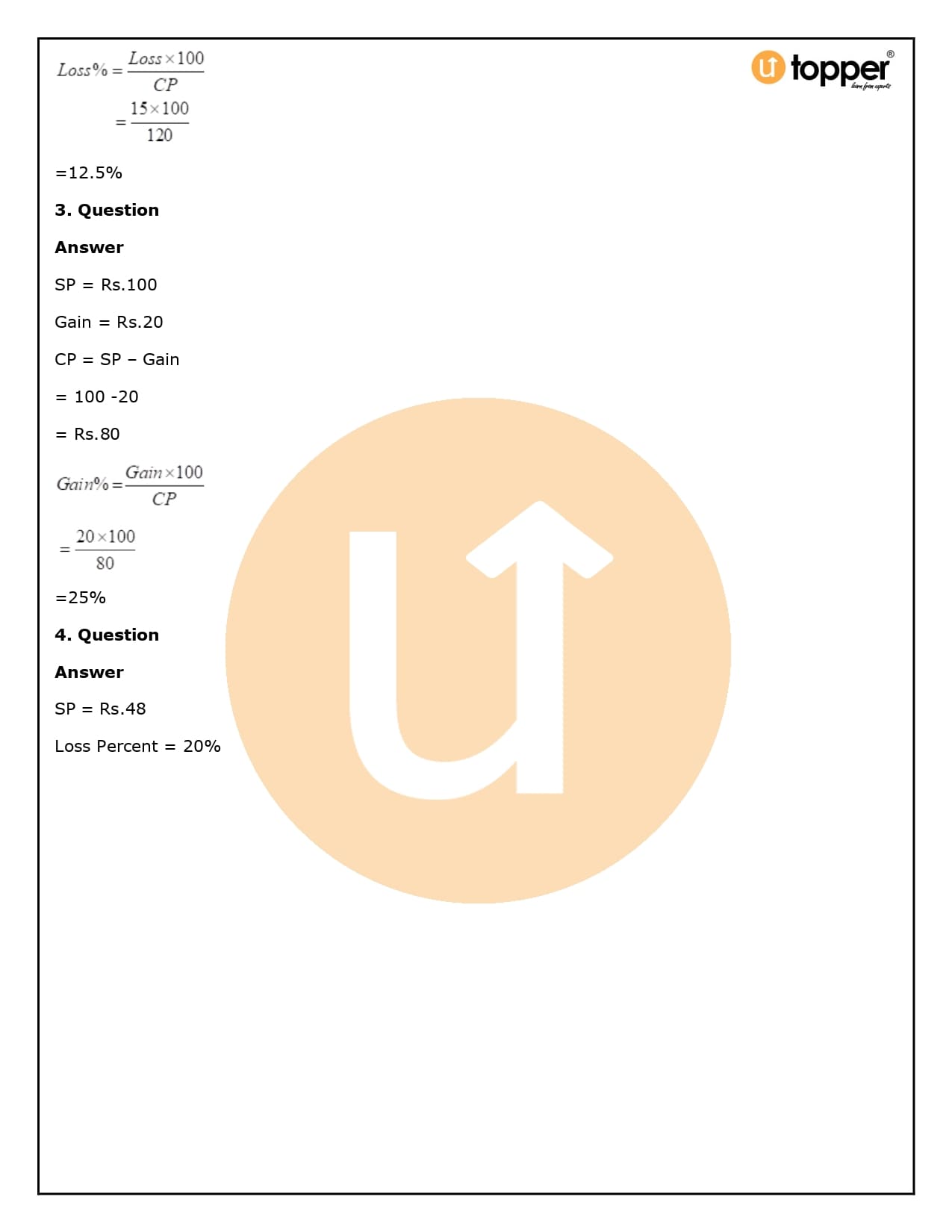

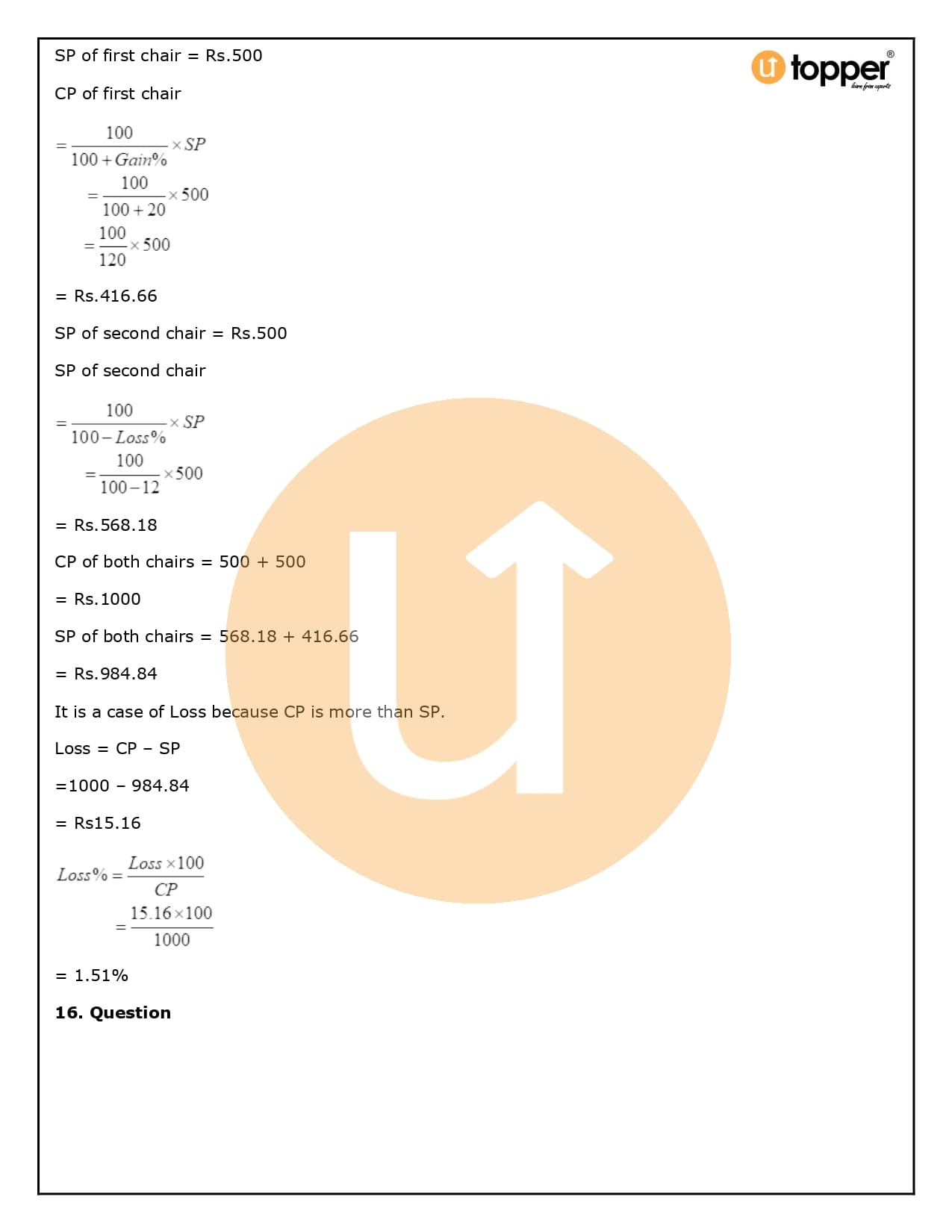

Getting the percentage of loss

The formulas below make it easy to figure out the loss percentage:

- Loss % = (loss/ CP × 100)%

From the information given, you can also figure out the item’s selling price and cost price.

- Selling Price = (100 – loss %) /100 × CP

- Cost Price = 100 /(100 – loss %) × SP

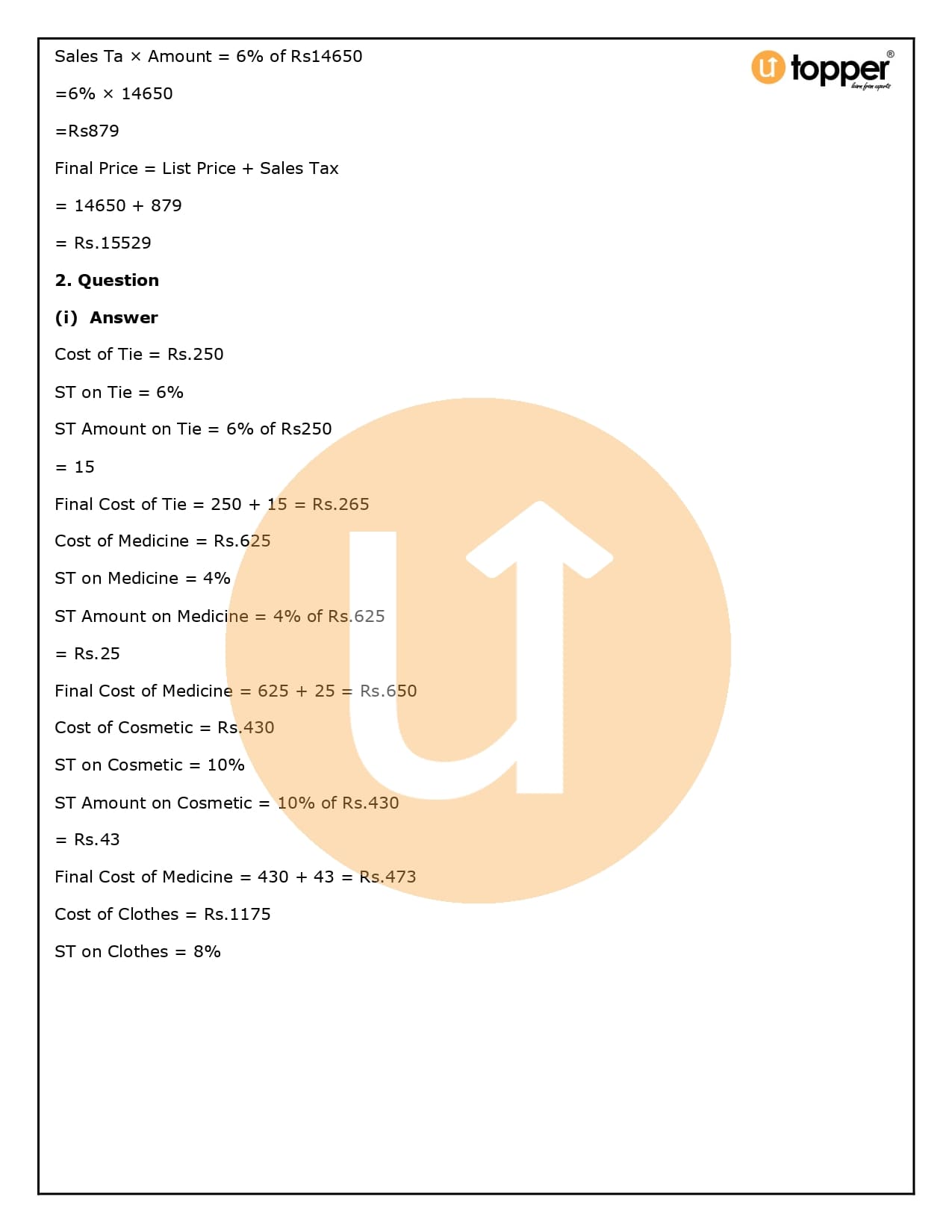

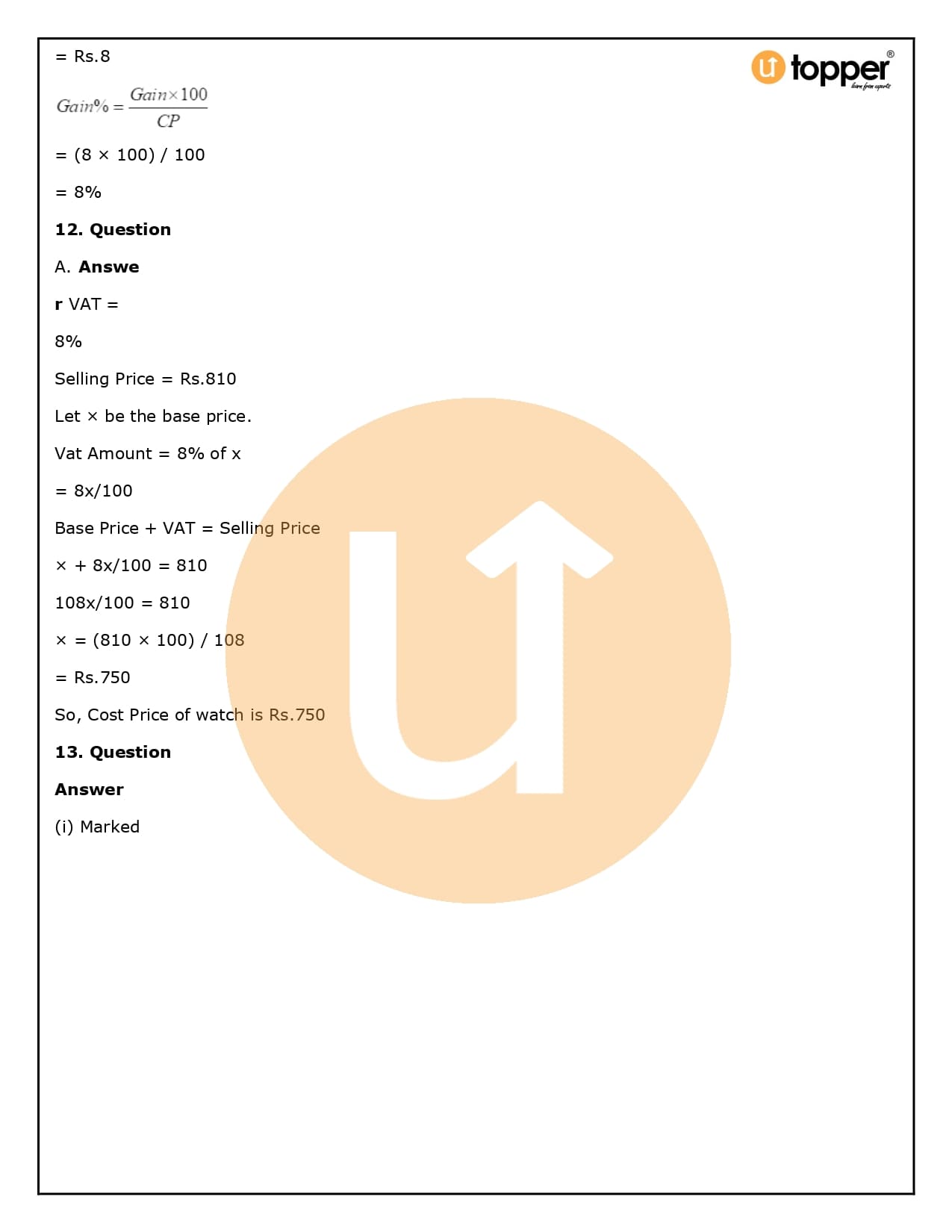

How to figure out Value-Added Tax (VAT)

The government must be paid VAT = (Output VAT- Input VAT)

Output VAT means the tax that is paid when goods are sold. The output VAT is added to the price of the goods when they are sold.

Input VAT = The tax you pay when you buy something is what Input VAT stands for. The cost price of the goods is used to figure out how much VAT is due.

FAQ ( Frequently Asked Questions )

1. What concepts are covered in RS Aggarwal Class 8 Solutions Chapter 10 Profit and Loss?

Ans – We learned how to figure out how much money we made or lost when we bought or sold things up to Class 7 and how to figure out the percentage. Now, in RS Aggarwal Class 8 Solutions Chapter 10, we’ll learn more about making money and losing money. This includes the idea of discounts when buying and selling things, as well as Value Added Tax at the end of the chapter (VAT).

By separating the topics, we can see that we will need to understand and study the ideas of cost price, selling price, profit, and loss, discount issues, and Value Added Tax problems (VAT).

2. How will Utopper help me solve the questions in RS Aggarwal Solutions for Class 8 Chapter 10 (Profit and loss)?

Ans – Utopper enrolls students of all merit. Once you join Utopper, it’s our job to help you get better at math so you can do the hardest problems. Utopper’s regular classes help them understand the most important ideas in a deeper way.

The student can learn the concepts at his or her own pace with Utopper. The notes are made after a lot of research so that the students will know enough about the subject to do well on their exams. Utopper helps the student see learning as something fun instead of something they have to do.