What Is the Full Form of MICR?

The MICR full form is Magnetic Ink Character Recognition. MICR code (Magnetic Ink Character Recognition Code) is a pattern recognition technology primarily used by the banking industry to identify the authenticity of a document and to facilitate the processing and approval of checks and other paperwork. It is a technology that makes use of particular characters and ink.

Read Other Full Forms

Characteristics of MICR code

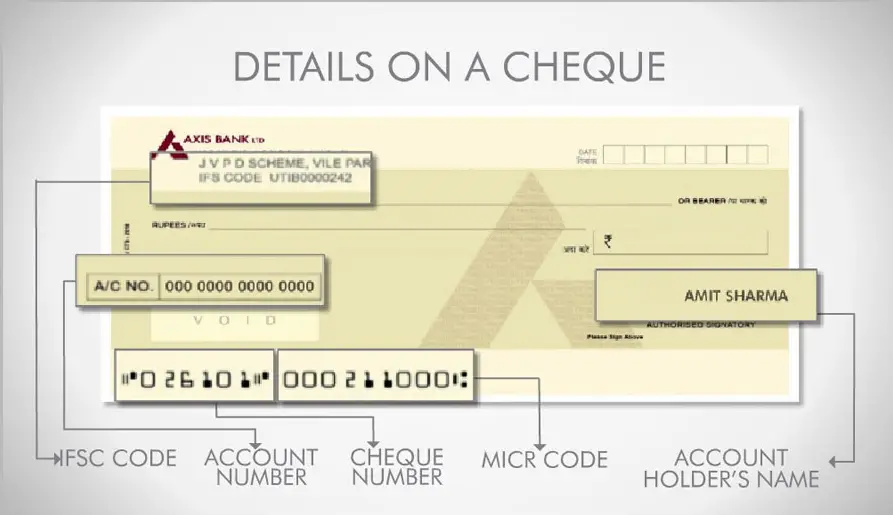

MICR is a nine-digit code that uniquely identifies the bank and branch participating in an ECS (Electronic Clearing System). Next to the cheque number at the bottom of a cheque leaf is the MICR code. It is also printed on the very first page of the passbook for a bank savings account.

3 Important Parts of MICR code

- City code — The initial three numbers indicate the city. They are paired with the PIN code used for postal addresses in India.

- Bank code – The next three digits reflect a bank.

- Branch code – The last three figures indicate the branch.

Working of MICR method

On paper, the MICR code is displayed in two distinct formats. The first is CMC-7 and the second is E-13B. Magnet ink is the ink utilized for printing. The transfer of the MICR code from the MICR reader permits accurate reading of characters obscured by other marks, such as signatures and stamps.

When claiming various types of financial transactions, such as investment types or SIP forms, or when sending money, the MICR code should be considered.

Components of the MICR code

- Even with a stamp or sign covering it, it is immediately identifiable. So it is advantageous. It generates a very secure network since it is difficult to track the same ink, making document forgery extremely difficult.

- In this instance, the rate of mistakes is modest.

- Fonts that do not meet these requirements are either rejected or disapproved.

Difference between the IFSC code and MICR code

The primary distinction between the two is that the IFSC Code is utilized for NEFT and RTGS money transfers. On the other hand, the MICR code is only utilized on check leaves.